425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on March 9, 2021

Filed by Paysafe Limited pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Foley Trasimene Acquisition Corp. II SEC File No.: 001-39456 Date: March 9, 2021

March 9th, 2021 Analyst Day Presentation

Legal disclaimer Important Information About the Proposed Business Combination and Where to Find It In connection with the proposed business combination, a registration statement on Form F-4 (the “Form F-4”) has been filed by Paysafe Limited, an exempted limited company incorporated under the laws of Bermuda (“Paysafe”) with the U.S. Securities and Exchange Commission (“SEC”) that includes preliminary and definitive proxy statements that have been distributed to holders of FTAC’s common stock in connection with FTAC’s solicitation for proxies for the vote by FTAC’s stockholders in connection with the proposed business combination and other matters as described in the Form F-4, as well as a prospectus of Paysafe relating to the offer of the securities to be issued in connection with the completion of the business combination. FTAC, PGHL AND PAYSAFE urge investors, stockholders and other interested persons to read the Form F-4, including the proxy statement/prospectus included therein, as well as other documents filed with the SEC in connection with the proposed business combination, as these materials contain important information about PGHL, FTAC, and the proposed business combination. Such persons can also read FTAC’s final prospectus dated August 20, 2020 (SEC File No. 333-240285), for a description of the security holdings of FTAC’s officers and directors and their respective interests as security holders in the consummation of the proposed business combination. The definitive proxy statement/prospectus has been mailed to FTAC’s stockholders as of the record date established for voting on the proposed business combination. Stockholders will also be able to obtain copies of such documents, without charge, at the SEC’s website at www.sec.gov, or by directing a request to: Foley Trasimene Acquisition Corp. II, 1701 Village Center Circle, Las Vegas, NV 89134, or (702) 323-7330. Participants in the Solicitation FTAC, PGHL, Paysafe and their respective directors, executive officers and other members of their management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of FTAC’s stockholders in connection with the proposed business combination. Investors and security holders may obtain more detailed information regarding the names, affiliations and interests of FTAC’s directors and executive officers in FTAC’s final prospectus dated August 20, 2020 (SEC File No. 333-240285), which was filed with the SEC on August 13, 2020. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of FTAC’s stockholders in connection with the proposed business combination is set forth in the proxy statement/prospectus for the proposed business combination. Information concerning the interests of FTAC’s and PGHL’s participants in the solicitation, which may, in some cases, be different than those of FTAC’s and PGHL’s equity holders generally, is set forth in the proxy statement/prospectus relating to the proposed business combination. Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. FTAC’s and PGHL’s actual results may differ from their expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions (or the negative versions of such words or expressions) are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, FTAC’s and PGHL’s expectations with respect to future performance and anticipated financial impacts of the proposed business combination, the satisfaction or waiver of the closing conditions to the proposed business combination, and the timing of the completion of the proposed business combination. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially, and potentially adversely, from those expressed or implied in the forward-looking statements. Most of these factors are outside FTAC’s and PGHL’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the occurrence of any event, change, or other circumstances that could give rise to the termination of the definitive merger agreement (the “Agreement”); (2) the outcome of any legal proceedings that may be instituted against FTAC, Paysafe and/or PGHL following the announcement of the Agreement and the transactions contemplated therein; (3) the inability to complete the proposed business combination, including due to failure to obtain approval of the stockholders of FTAC, certain regulatory approvals, or satisfy other conditions to closing in the Agreement; (4) the occurrence of any event, change, or other circumstance that could give rise to the termination of the Agreement or could otherwise cause the transaction to fail to close; (5) the impact of COVID-19 on PGHL’s business and/or the ability of the parties to complete the proposed business combination; (6) the inability to obtain or maintain the listing of Paysafe’s shares of common stock on the New York Stock Exchange following the proposed business combination; (7) the risk that the proposed business combination disrupts current plans and operations as a result of the announcement and consummation of the proposed business combination; (8) the ability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, competition, the ability of PGHL to grow and manage growth profitably, and retain its key employees; (9) costs related to the proposed business combination; (10) changes in applicable laws or regulations; and (11) the possibility that PGHL, FTAC or Paysafe may be adversely affected by other economic, business, and/or competitive factors. The foregoing list of factors is not exclusive. Additional information concerning certain of these and other risk factors is contained in FTAC’s most recent filings with the SEC and in the Form F-4, including the proxy statement/prospectus filed in connection with the proposed business combination. All subsequent written and oral forward-looking statements concerning FTAC, PGHL or Paysafe, the transactions described herein or other matters and attributable to FTAC, PGHL, Paysafe or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Each of FTAC, PGHL and Paysafe expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in their expectations with respect thereto or any change in events, conditions, or circumstances on which any statement is based, except as required by law. No Offer or Solicitation This presentation is not a proxy statement or solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the proposed business combination and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of FTAC, Paysafe or PGHL, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or exemptions therefrom. Trademarks This presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this presentation may be listed without the TM, SM © or ® symbols, but Paysafe will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. Statement Regarding Non-GAAP Financial Measures This presentation also contains non-GAAP financial information. Paysafe management believes the presentation of these non-GAAP financial measures, when considered together with the Company’s results presented in accordance with GAAP, provide users with useful supplemental information regarding Paysafe’s operating performance. Reconciliations of these non-GAAP financial measures to their most directly comparable GAAP measures are set forth in the Appendix. These non-GAAP measures exclude items that are significant in understanding and assessing Paysafe’s financial results or position. Therefore, these measures should not be considered in isolation or as alternatives to measures under GAAP.

Presenters Philip McHugh Chief Executive Officer & Director Izzy Dawood Chief Financial Officer Danny Chazonoff Chief Operating Officer Philip joined Paysafe in 2019 as CEO Philip has been an international leader in the banking and payments industry for over 25 years with experience across Latin America, Europe, EMEA, and North America Prior experience: Izzy joined Paysafe in 2020 as CFO Izzy brings a proven track record of over 25 years in financial leadership in both public and private organizations Prior experience: Danny is one of the founders of the Company and has served as COO since 2006. Prior to that was CTO from 1999 to 2005 Danny brings more than 20 years of payment industry experience and 35 years of technology and operations experience Prior experience:

1. Overview of Paysafe

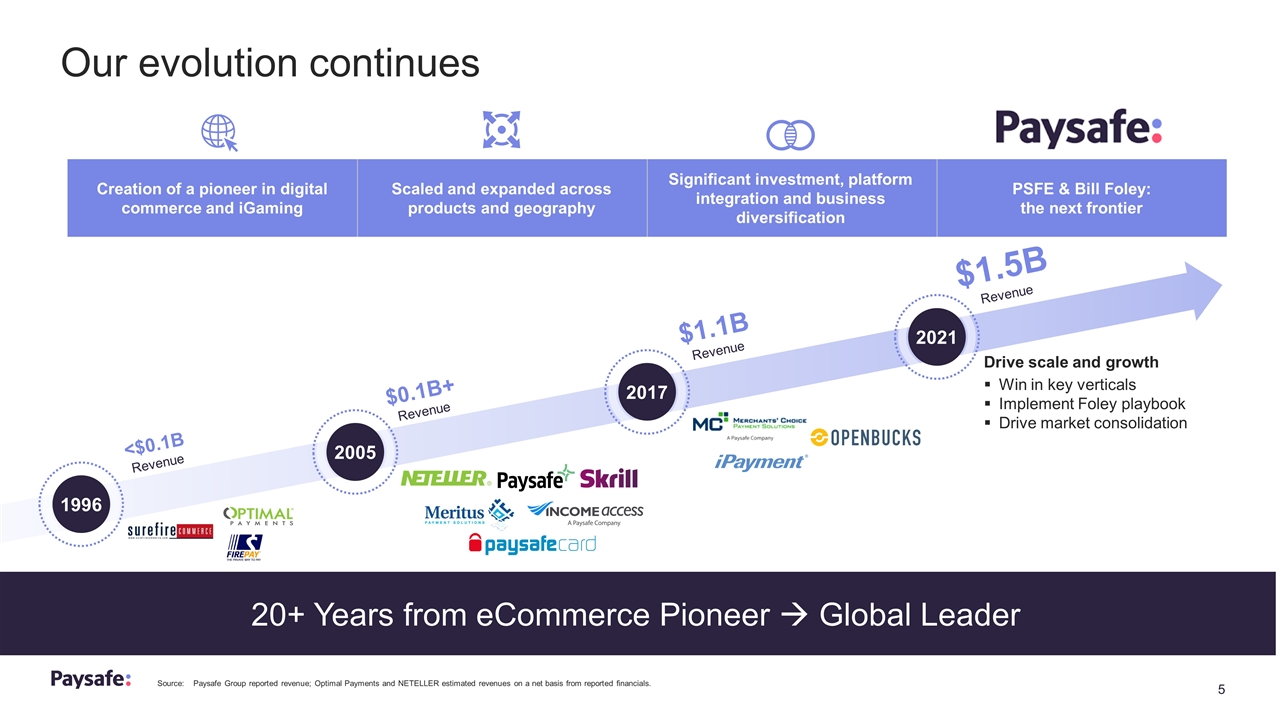

Our evolution continues Source: Paysafe Group reported revenue; Optimal Payments and NETELLER estimated revenues on a net basis from reported financials. Creation of a pioneer in digital commerce and iGaming Scaled and expanded across products and geography Significant investment, platform integration and business diversification PSFE & Bill Foley: the next frontier 1996 <$0.1B Revenue $0.1B+ Revenue $1.1B Revenue $1.5B Revenue 20+ Years from eCommerce Pioneer à Global Leader 2005 2021 2017 Drive scale and growth Win in key verticals Implement Foley playbook Drive market consolidation

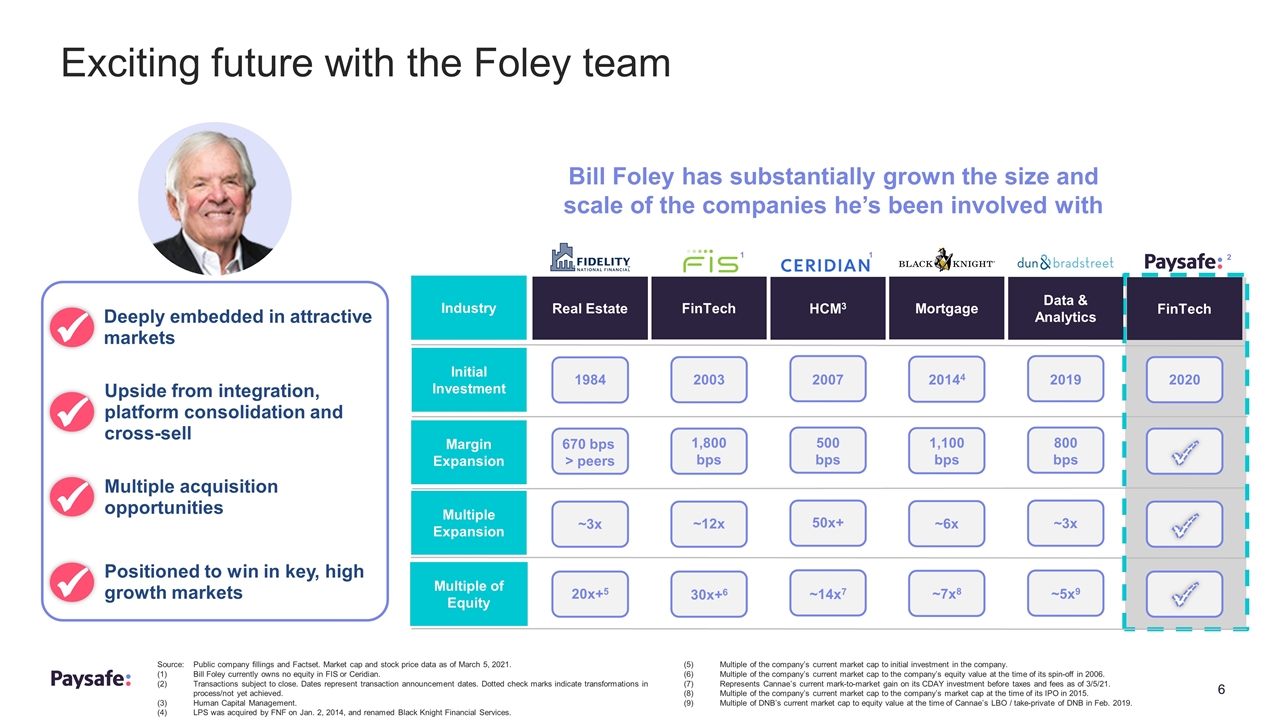

Exciting future with the Foley team Deeply embedded in attractive markets ü Upside from integration, platform consolidation and cross-sell ü Multiple acquisition opportunities ü Positioned to win in key, high growth markets ü Bill Foley has substantially grown the size and scale of the companies he’s been involved with Source: Public company fillings and Factset. Market cap and stock price data as of March 5, 2021. (1)Bill Foley currently owns no equity in FIS or Ceridian. (2)Transactions subject to close. Dates represent transaction announcement dates. Dotted check marks indicate transformations in process/not yet achieved. (3)Human Capital Management. (4)LPS was acquired by FNF on Jan. 2, 2014, and renamed Black Knight Financial Services. (5)Multiple of the company’s current market cap to initial investment in the company. (6)Multiple of the company’s current market cap to the company’s equity value at the time of its spin-off in 2006. (7)Represents Cannae’s current mark-to-market gain on its CDAY investment before taxes and fees as of 3/5/21. (8)Multiple of the company’s current market cap to the company’s market cap at the time of its IPO in 2015. (9)Multiple of DNB’s current market cap to equity value at the time of Cannae’s LBO / take-private of DNB in Feb. 2019. Industry Initial Investment Margin Expansion Multiple Expansion Multiple of Equity 1 1 FinTech Real Estate HCM3 Mortgage Data & Analytics FinTech 1984 20x+5 670 bps > peers ~3x 2003 30x+6 1,800 bps ~12x 2007 ~14x7 500 bps 50x+ 20144 ~7x8 1,100 bps ~6x 2019 ~5x9 800 bps ~3x 2020 ü ü ü 2

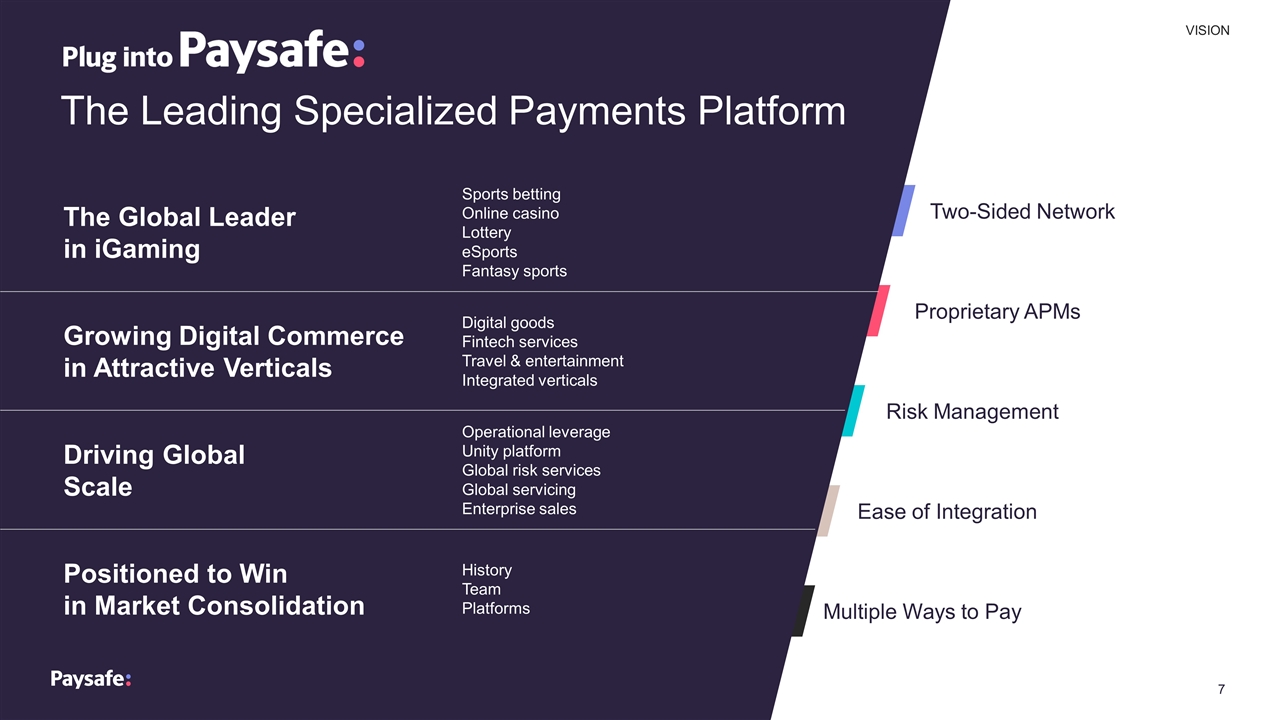

Two-Sided Network Proprietary APMs Risk Management Ease of Integration Multiple Ways to Pay The Leading Specialized Payments Platform The Global Leader in iGaming Sports betting Online casino Lottery eSports Fantasy sports Growing Digital Commerce in Attractive Verticals Digital goods Fintech services Travel & entertainment Integrated verticals Positioned to Win in Market Consolidation History Team Platforms Driving Global Scale Operational leverage Unity platform Global risk services Global servicing Enterprise sales VISION

A global pioneer in digital commerce Note:Integrated as defined on slide 62. 2021E numbers represent midpoints of guidance. ~$105bn Total Volume ’21E ~$1.5bn Revenue ’21E Highly differentiated B2B and B2C global network with a powerful suite of digital wallet, eCash and integrated processing solutions 1 Significant growth opportunities in massive TAM with expertise in highest value verticals 2 Long history as the global market leader in iGaming payments and well positioned to capitalize on the expanding U.S. market 3 Proprietary and scalable platform in technology and risk management driving a proven M&A playbook 4 Experienced management team with an entrepreneurial and client-focused culture 5

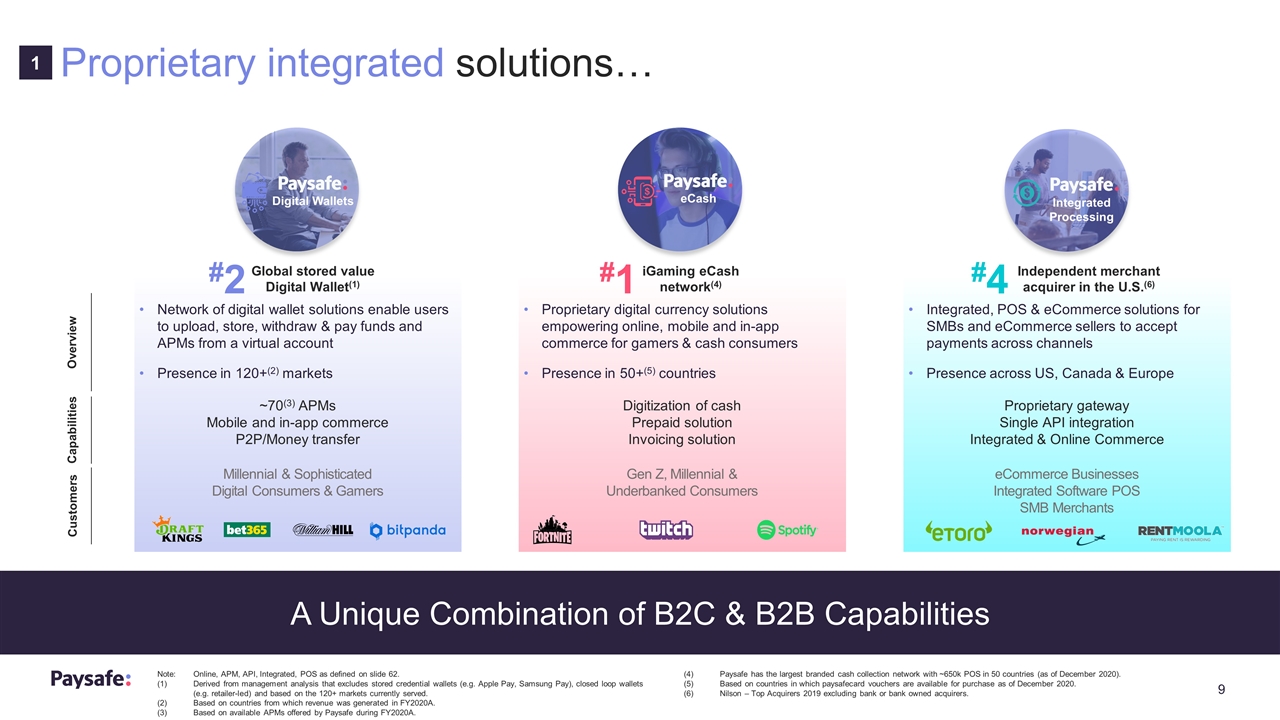

Proprietary integrated solutions… Note:Online, APM, API, Integrated, POS as defined on slide 62. (1)Derived from management analysis that excludes stored credential wallets (e.g. Apple Pay, Samsung Pay), closed loop wallets (e.g. retailer-led) and based on the 120+ markets currently served. (2)Based on countries from which revenue was generated in FY2020A. (3)Based on available APMs offered by Paysafe during FY2020A. (4)Paysafe has the largest branded cash collection network with ~650k POS in 50 countries (as of December 2020). (5)Based on countries in which paysafecard vouchers are available for purchase as of December 2020. (6)Nilson – Top Acquirers 2019 excluding bank or bank owned acquirers. 1 Capabilities Customers Overview ~70(3) APMs Mobile and in-app commerce P2P/Money transfer Millennial & Sophisticated Digital Consumers & Gamers Network of digital wallet solutions enable users to upload, store, withdraw & pay funds and APMs from a virtual account Presence in 120+(2) markets Digitization of cash Prepaid solution Invoicing solution Gen Z, Millennial & Underbanked Consumers Proprietary digital currency solutions empowering online, mobile and in-app commerce for gamers & cash consumers Presence in 50+(5) countries Proprietary gateway Single API integration Integrated & Online Commerce eCommerce Businesses Integrated Software POS SMB Merchants Integrated, POS & eCommerce solutions for SMBs and eCommerce sellers to accept payments across channels Presence across US, Canada & Europe Global stored value Digital Wallet(1) #2 iGaming eCash network(4) #1 Independent merchant acquirer in the U.S.(6) #4 eCash Integrated Processing Digital Wallets A Unique Combination of B2C & B2B Capabilities

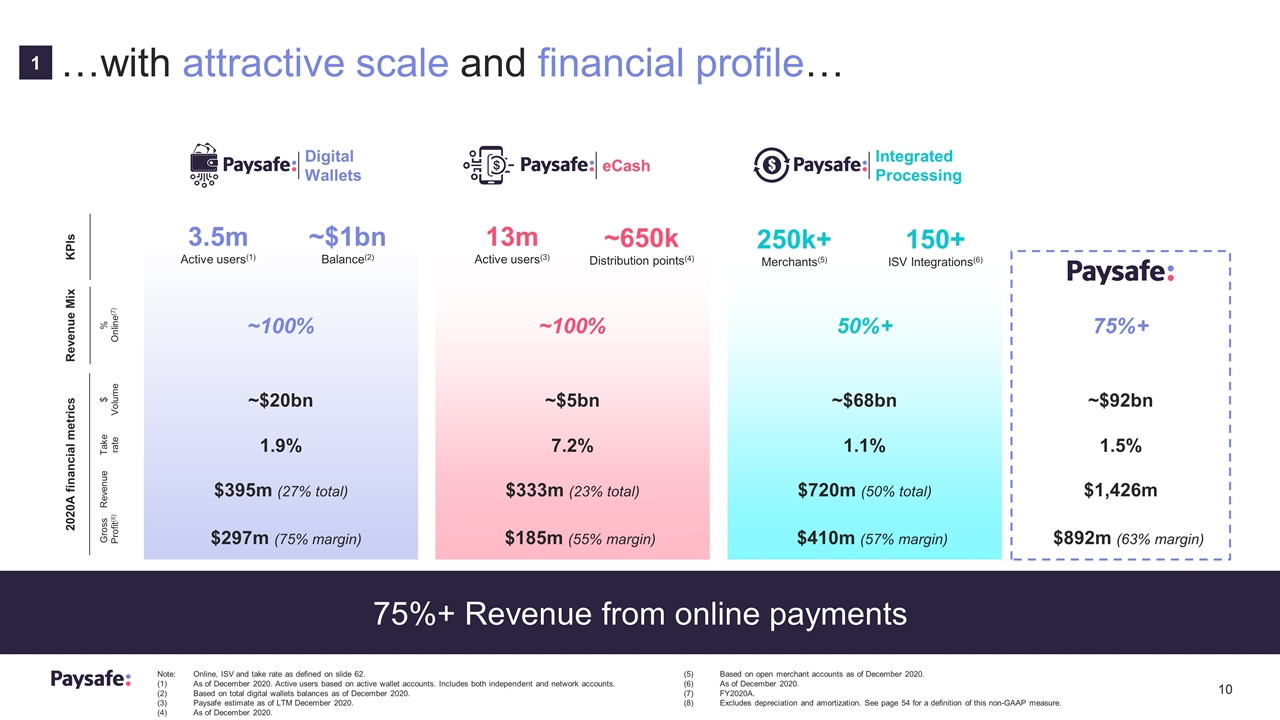

…with attractive scale and financial profile… Note:Online, ISV and take rate as defined on slide 62. (1)As of December 2020. Active users based on active wallet accounts. Includes both independent and network accounts. (2)Based on total digital wallets balances as of December 2020. (3)Paysafe estimate as of LTM December 2020. (4)As of December 2020. (5)Based on open merchant accounts as of December 2020. (6)As of December 2020. (7)FY2020A. (8)Excludes depreciation and amortization. See page 54 for a definition of this non-GAAP measure. KPIs 2020A financial metrics $ Volume % Online(7) Revenue Gross Profit(8) Take rate Revenue Mix 13m Active users(3) ~650k Distribution points(4) 250k+ Merchants(5) 3.5m Active users(1) ~$1bn Balance(2) 150+ ISV Integrations(6) ~$20bn ~$5bn ~$68bn ~$92bn ~100% ~100% 50%+ 75%+ $395m (27% total) $333m (23% total) $720m (50% total) $1,426m $297m (75% margin) $185m (55% margin) $410m (57% margin) $892m (63% margin) 1.9% 7.2% 1.1% 1.5% Digital Wallets eCash Integrated Processing 75%+ Revenue from online payments 1

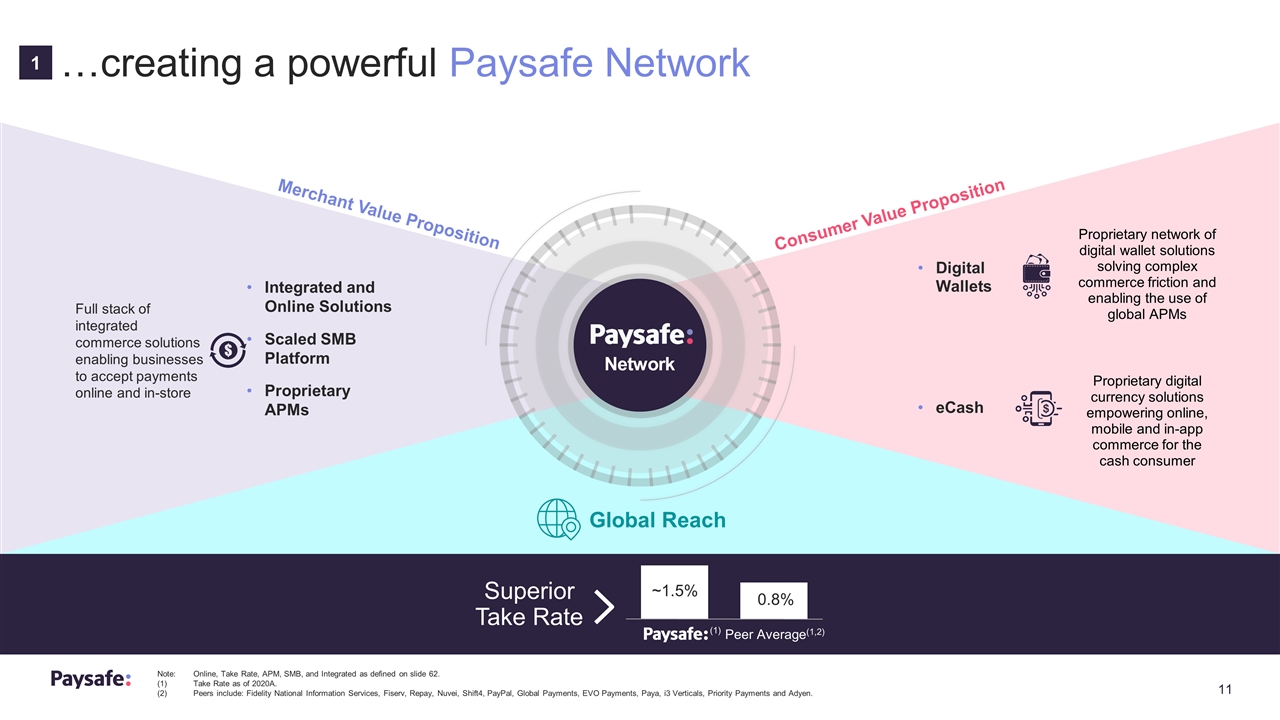

…creating a powerful Paysafe Network Note:Online, Take Rate, APM, SMB, and Integrated as defined on slide 62. (1)Take Rate as of 2020A. (2)Peers include: Fidelity National Information Services, Fiserv, Repay, Nuvei, Shift4, PayPal, Global Payments, EVO Payments, Paya, i3 Verticals, Priority Payments and Adyen. Superior Take Rate Peer Average(1,2) ~1.5% 0.8% (1) Network Merchant Value Proposition Consumer Value Proposition Global Reach Integrated and Online Solutions Scaled SMB Platform Proprietary APMs Full stack of integrated commerce solutions enabling businesses to accept payments online and in-store Digital Wallets eCash Proprietary network of digital wallet solutions solving complex commerce friction and enabling the use of global APMs Proprietary digital currency solutions empowering online, mobile and in-app commerce for the cash consumer 1

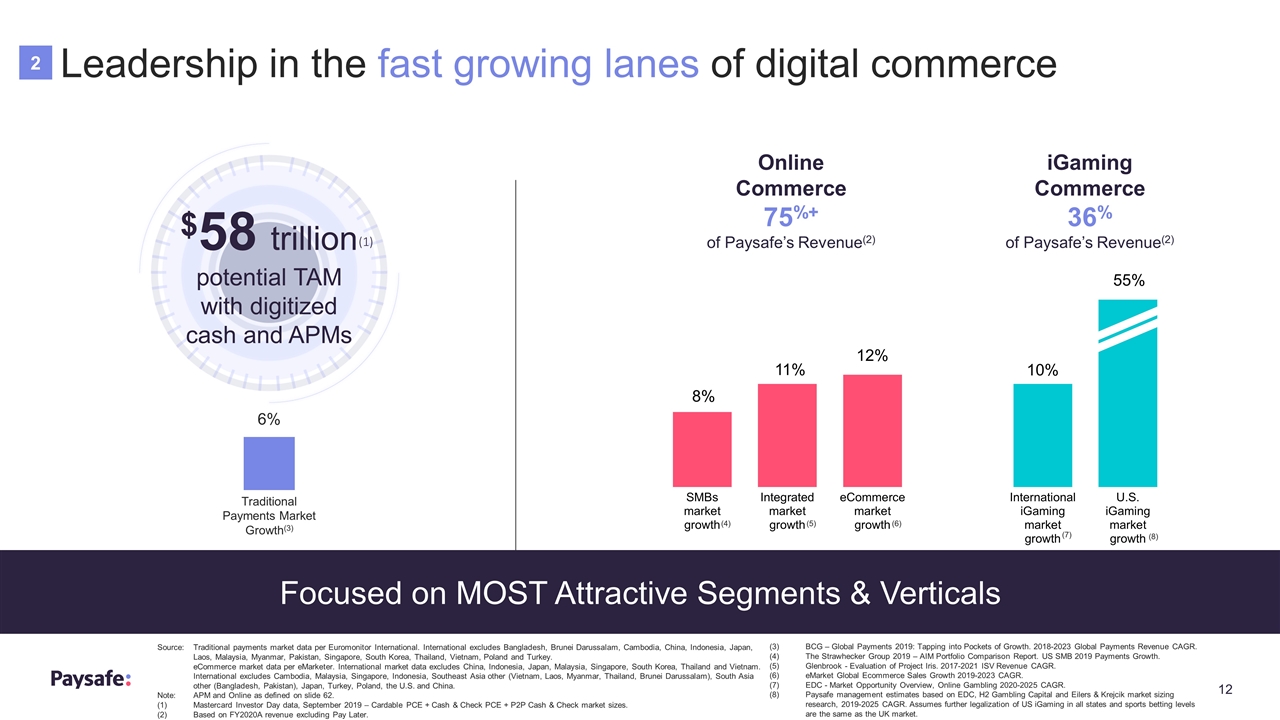

Source:Traditional payments market data per Euromonitor International. International excludes Bangladesh, Brunei Darussalam, Cambodia, China, Indonesia, Japan, Laos, Malaysia, Myanmar, Pakistan, Singapore, South Korea, Thailand, Vietnam, Poland and Turkey. eCommerce market data per eMarketer. International market data excludes China, Indonesia, Japan, Malaysia, Singapore, South Korea, Thailand and Vietnam. International excludes Cambodia, Malaysia, Singapore, Indonesia, Southeast Asia other (Vietnam, Laos, Myanmar, Thailand, Brunei Darussalam), South Asia other (Bangladesh, Pakistan), Japan, Turkey, Poland, the U.S. and China. Note:APM and Online as defined on slide 62. (1)Mastercard Investor Day data, September 2019 – Cardable PCE + Cash & Check PCE + P2P Cash & Check market sizes. (2)Based on FY2020A revenue excluding Pay Later. Leadership in the fast growing lanes of digital commerce Online Commerce 75%+ of Paysafe’s Revenue(2) iGaming Commerce 36% of Paysafe’s Revenue(2) $58 trillion potential TAM with digitized cash and APMs 6% Traditional Payments Market Growth(3) (4) (5) (6) (7) (8) (1) (3)BCG – Global Payments 2019: Tapping into Pockets of Growth. 2018-2023 Global Payments Revenue CAGR. (4)The Strawhecker Group 2019 – AIM Portfolio Comparison Report. US SMB 2019 Payments Growth. (5)Glenbrook - Evaluation of Project Iris. 2017-2021 ISV Revenue CAGR. (6)eMarket Global Ecommerce Sales Growth 2019-2023 CAGR. (7)EDC - Market Opportunity Overview, Online Gambling 2020-2025 CAGR. (8)Paysafe management estimates based on EDC, H2 Gambling Capital and Eilers & Krejcik market sizing research, 2019-2025 CAGR. Assumes further legalization of US iGaming in all states and sports betting levels are the same as the UK market. Focused on MOST Attractive Segments & Verticals 2

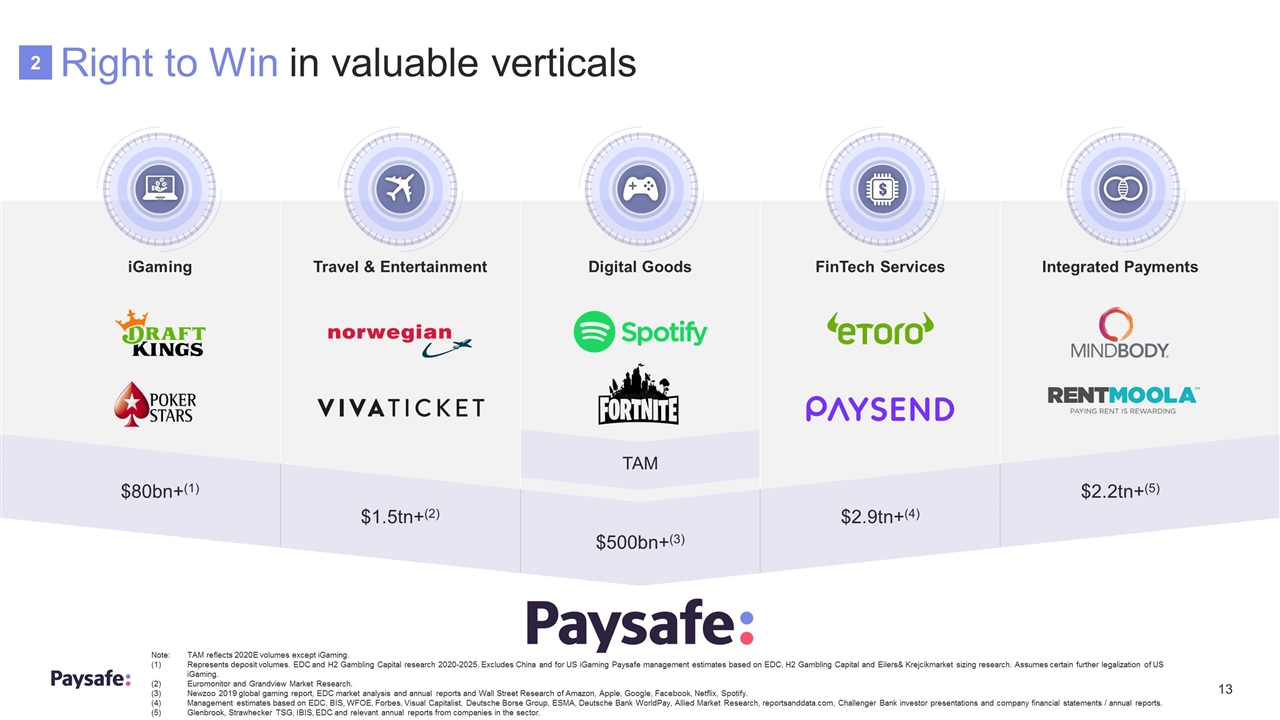

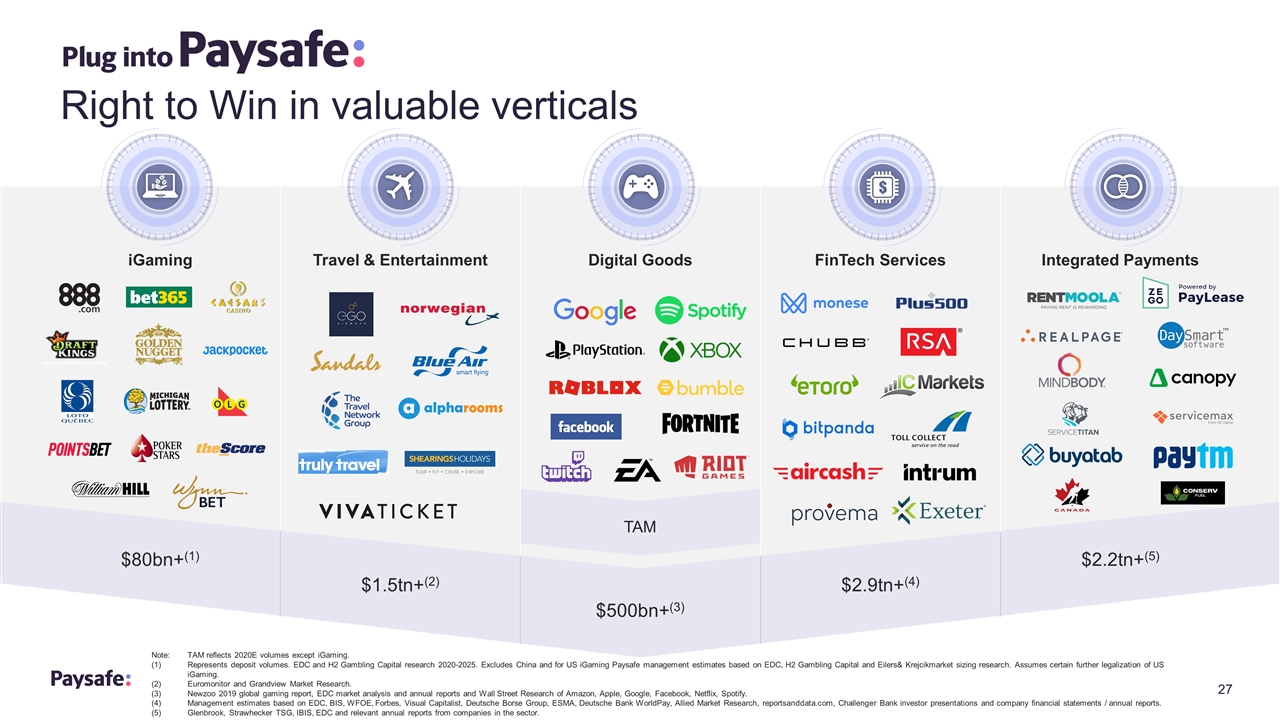

Right to Win in valuable verticals iGaming Digital Goods Travel & Entertainment Integrated Payments FinTech Services 2 TAM $80bn+(1) $500bn+(3) $1.5tn+(2) $2.2tn+(5) $2.9tn+(4) Note:TAM reflects 2020E volumes except iGaming. (1)Represents deposit volumes. EDC and H2 Gambling Capital research 2020-2025. Excludes China and for US iGaming Paysafe management estimates based on EDC, H2 Gambling Capital and Eilers& Krejcikmarket sizing research. Assumes certain further legalization of US iGaming. (2)Euromonitor and Grandview Market Research. (3) Newzoo 2019 global gaming report, EDC market analysis and annual reports and Wall Street Research of Amazon, Apple, Google, Facebook, Netflix, Spotify. (4)Management estimates based on EDC, BIS, WFOE, Forbes, Visual Capitalist, Deutsche Borse Group, ESMA, Deutsche Bank WorldPay, Allied Market Research, reportsanddata.com, Challenger Bank investor presentations and company financial statements / annual reports. (5)Glenbrook, Strawhecker TSG, IBIS, EDC and relevant annual reports from companies in the sector.

We are a global leader in iGaming Single integration Connectivity to ~70 APMs(6) Global risk and regulatory expertise Single solution for consumers & businesses Europe and Rest of World 10% CAGR Deposit volume ($bn)(2) Global leader with over 1,000(1) operators Launched in 1999 United States Deposit volume ($bn) $47bn 55% CAGR (4) (5) Live in 14 states Serves over 34 operators, representing ~75% of market Launched in 2013 Canada 15% CAGR Deposit volume ($bn)(3) 100% of Canada iGaming coverage – deployed Paysafe Market Playbook after launch Launched in 2010 3 (1)As of December 2020. (2)EDC and H2 Gambling Capital research 2020-2025. Excludes China and North America. (3)EDC - Market Opportunity Overview, Online Gambling 2020-2025 CAGR. (4)Paysafe management estimates based on EDC, H2 Gambling Capital and Eilers & Krejcik market sizing research, 2019-2025 CAGR. Assumes further legalization of US iGaming in all states and sports betting levels are the same as the UK market. (5)Paysafe management estimates based on EDC, H2 Gambling Capital and Eilers & Krejcik market sizing research, 2019-2025 CAGR. Assumes certain further legalization of US iGaming. (6)Based on available APMs offered by Paysafe during FY2020A.

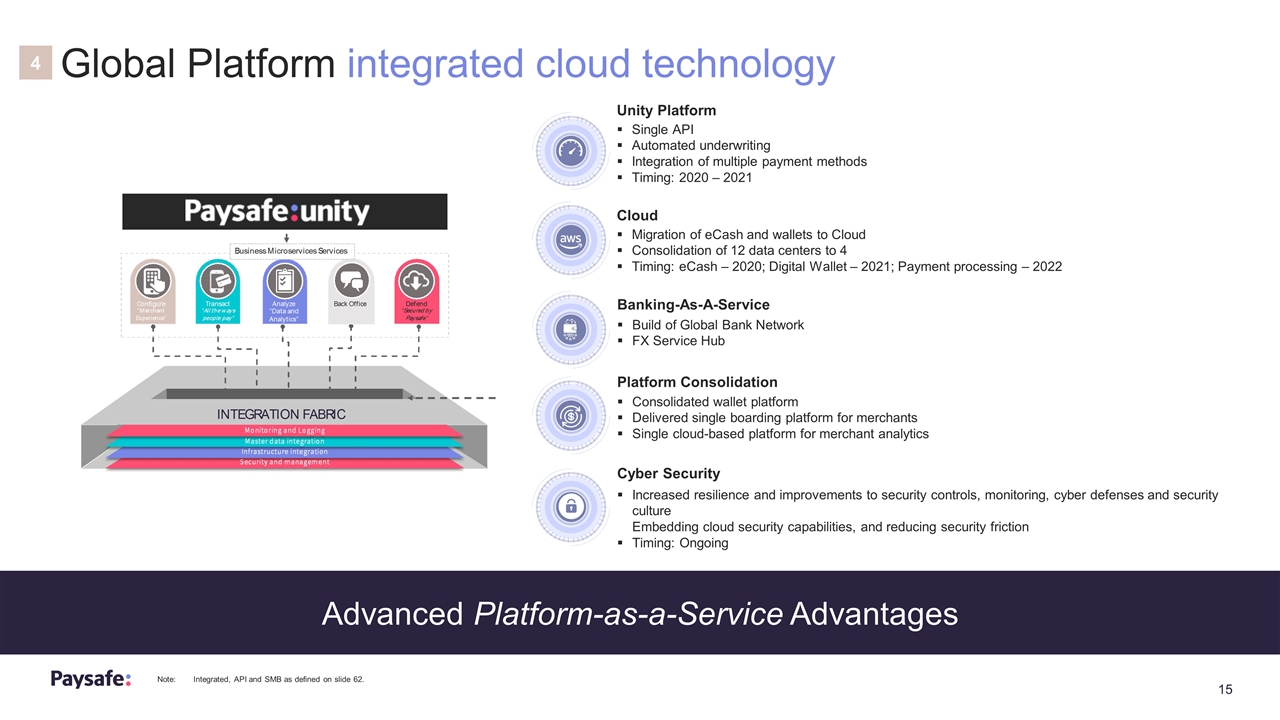

Note:Integrated, API and SMB as defined on slide 62. Global Platform integrated cloud technology Cyber Security Increased resilience and improvements to security controls, monitoring, cyber defenses and security culture Embedding cloud security capabilities, and reducing security friction Timing: Ongoing Cloud Migration of eCash and wallets to Cloud Consolidation of 12 data centers to 4 Timing: eCash – 2020; Digital Wallet – 2021; Payment processing – 2022 Unity Platform Single API Automated underwriting Integration of multiple payment methods Timing: 2020 – 2021 Platform Consolidation Consolidated wallet platform Delivered single boarding platform for merchants Single cloud-based platform for merchant analytics Banking-As-A-Service Build of Global Bank Network FX Service Hub Advanced Platform-as-a-Service Advantages 4

Global Platform risk & compliance 300+ Professionals Dedicated to Risk & Compliance and Analytics Highly developed Global Risk & Compliance Capabilities: Proven by Years of Successful Development in Complex Markets Two e-money licenses in Ireland Three e-money licenses in UK regulated by FCA Principal member: VISA and Mastercard Switzerland: Financial intermediary, regulated by FINMA US: Registered with the division of Gaming Enforcement, New Jersey Romania: Two Gambling service provider licenses US: Registered with the Delaware State Lottery Office Canada: Nova Scotia AGFT : Lottery equipment supplier US: Pennsylvania Gaming Control Board: Authorized service provider US: West Virginia State Lottery :Interim Supplier License Canada: Registered supplier in Ontario, regulated by Alcohol and Gaming Commission Canada: Registered with the British Columbia GPEB US: 45 state licenses US: Registered with the Colorado Control Commission US: Registered with the Tennessee Education Lottery Corporation US: Registered with the Michigan Gaming Control Board Gambling related registrations Payments related registrations Highly Strategic & Differentiated Expertise, Data & Analytics 4

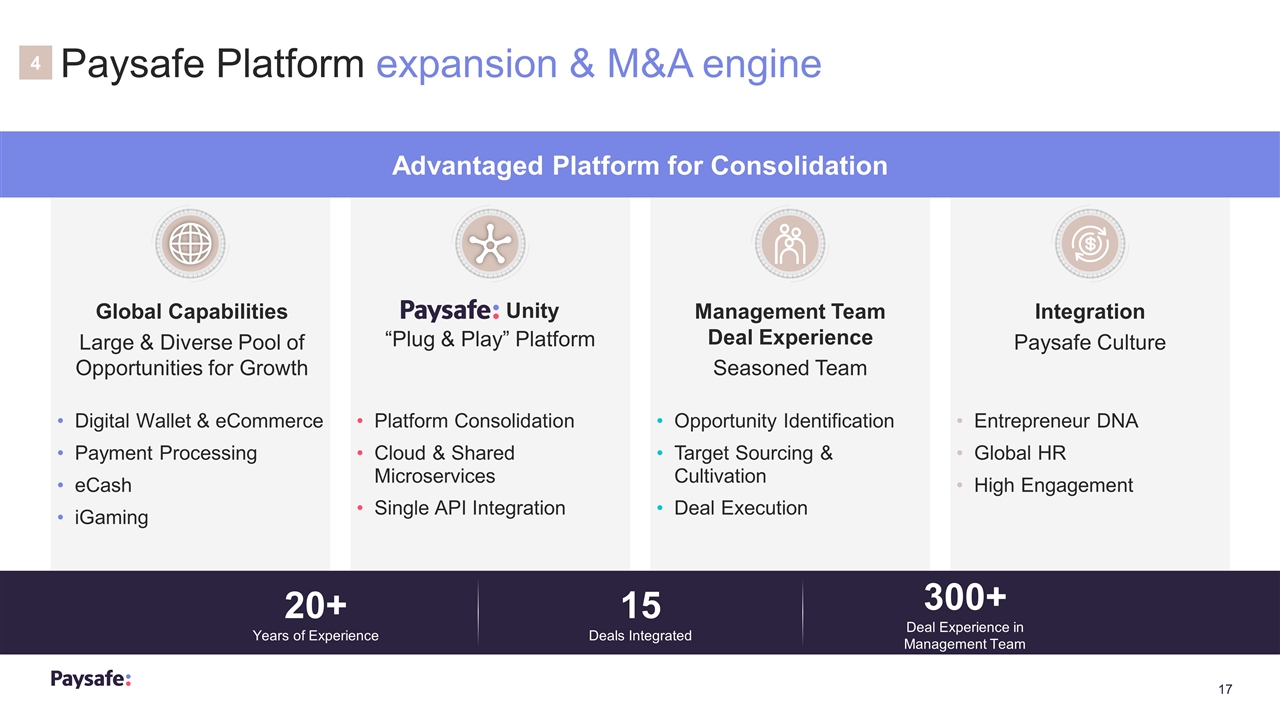

Paysafe Platform expansion & M&A engine 20+ Years of Experience 15 Deals Integrated 300+ Deal Experience in Management Team 4 Advantaged Platform for Consolidation Global Capabilities Large & Diverse Pool of Opportunities for Growth Digital Wallet & eCommerce Payment Processing eCash iGaming “Plug & Play” Platform Platform Consolidation Cloud & Shared Microservices Single API Integration Management Team Deal Experience Seasoned Team Opportunity Identification Target Sourcing & Cultivation Deal Execution Integration Paysafe Culture Entrepreneur DNA Global HR High Engagement Unity

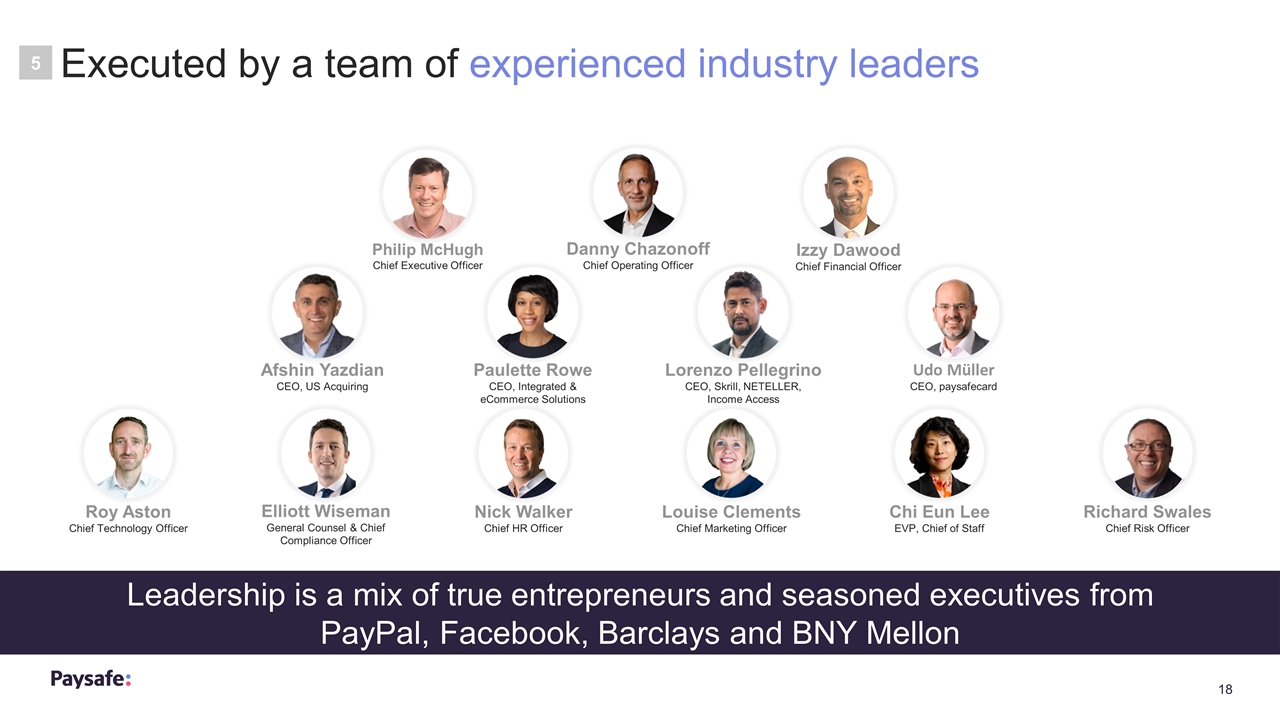

Executed by a team of experienced industry leaders Izzy Dawood Chief Financial Officer Danny Chazonoff Chief Operating Officer Philip McHugh Chief Executive Officer Paulette Rowe CEO, Integrated & eCommerce Solutions Lorenzo Pellegrino CEO, Skrill, NETELLER, Income Access Udo Müller CEO, paysafecard Afshin Yazdian CEO, US Acquiring Nick Walker Chief HR Officer Louise Clements Chief Marketing Officer Elliott Wiseman General Counsel & Chief Compliance Officer Chi Eun Lee EVP, Chief of Staff Roy Aston Chief Technology Officer Richard Swales Chief Risk Officer Leadership is a mix of true entrepreneurs and seasoned executives from PayPal, Facebook, Barclays and BNY Mellon 5

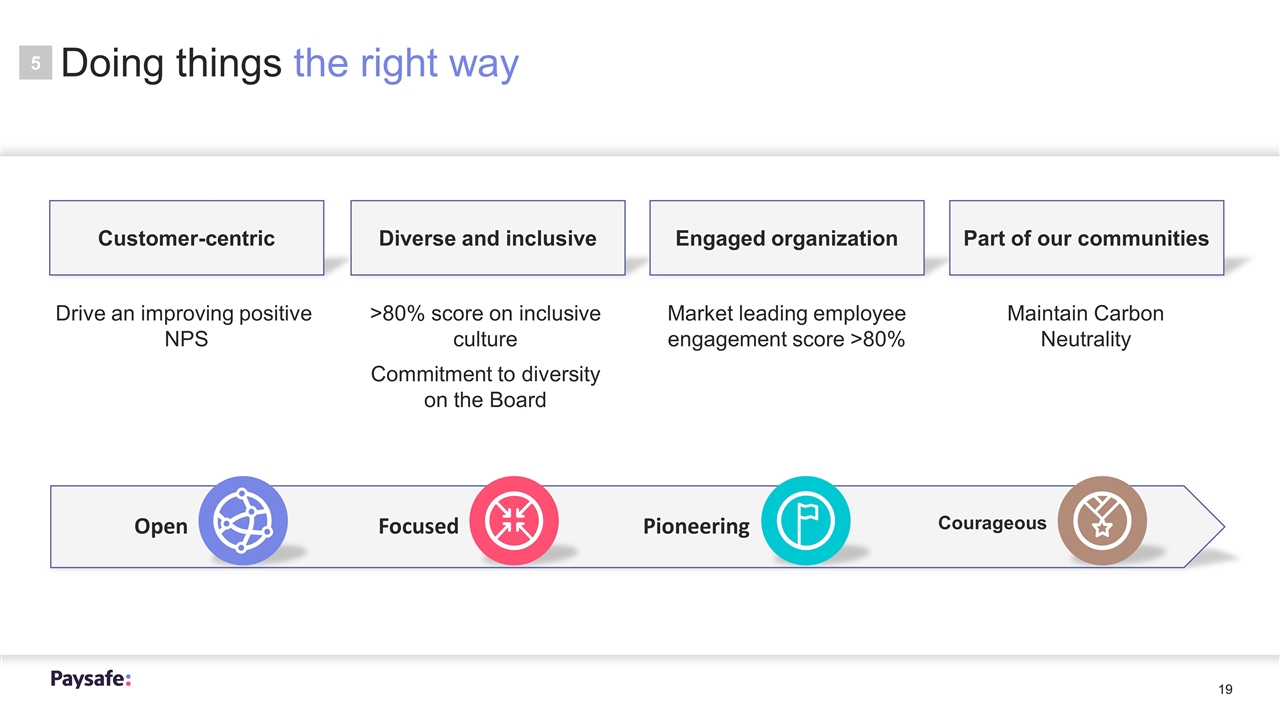

Doing things the right way 5 Drive an improving positive NPS Customer-centric >80% score on inclusive culture Commitment to diversity on the Board Diverse and inclusive Market leading employee engagement score >80% Engaged organization Maintain Carbon Neutrality Part of our communities Open Focused Pioneering Courageous

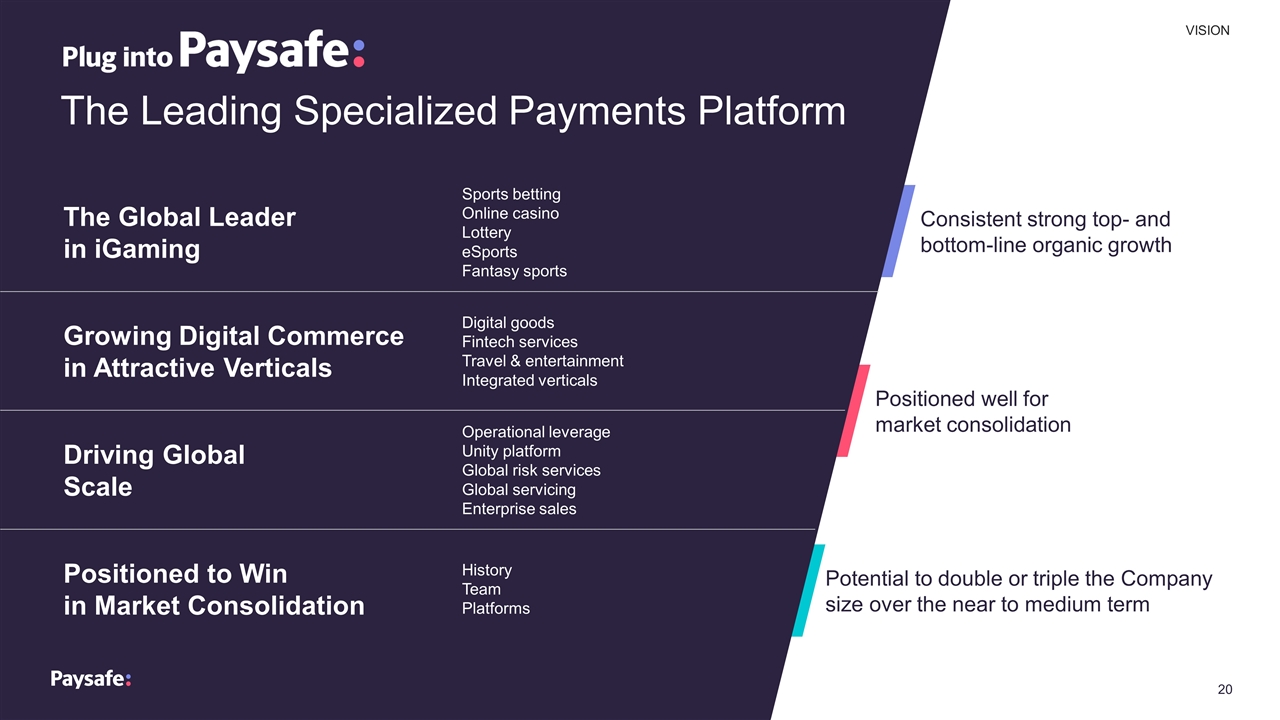

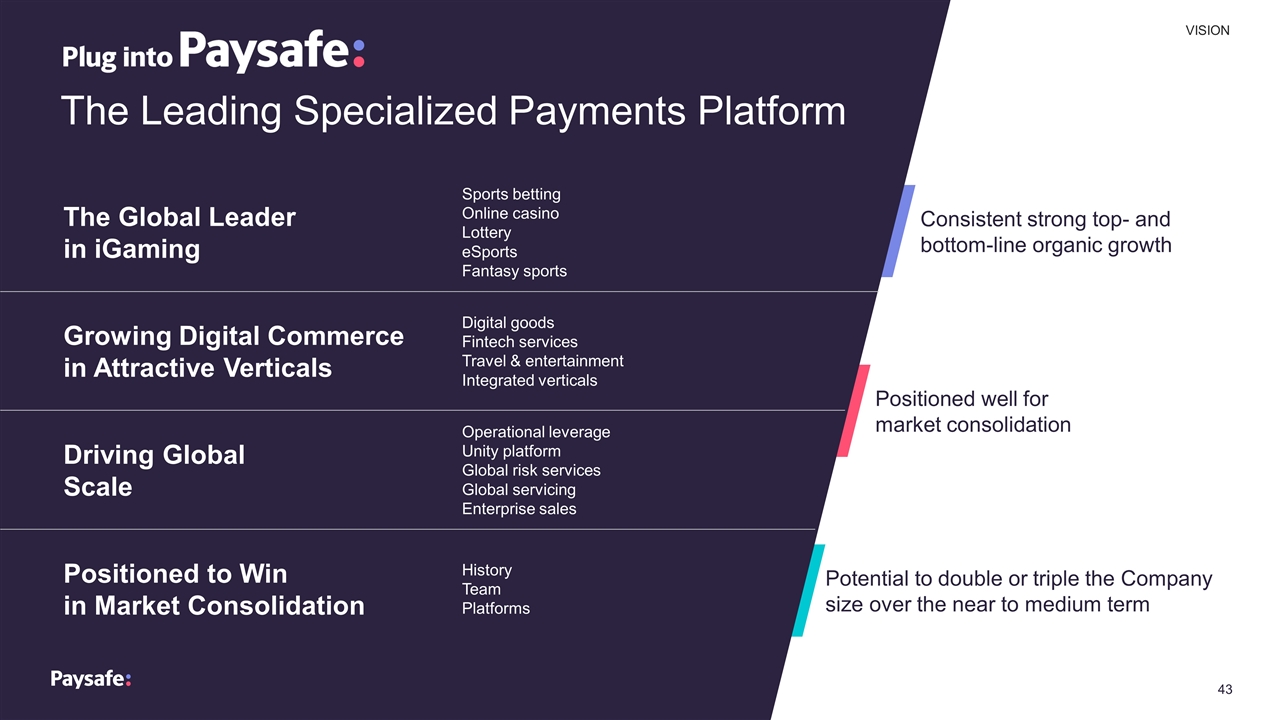

Consistent strong top- and bottom-line organic growth Positioned well for market consolidation Potential to double or triple the Company size over the near to medium term The Leading Specialized Payments Platform VISION Sports betting Online casino Lottery eSports Fantasy sports History Team Platforms Operational leverage Unity platform Global risk services Global servicing Enterprise sales Digital goods Fintech services Travel & entertainment Integrated verticals The Global Leader in iGaming Growing Digital Commerce in Attractive Verticals Positioned to Win in Market Consolidation Driving Global Scale

2. Product overview

3. Vision and growth strategy

Two-Sided Network Proprietary APMs Risk Management Ease of Integration Multiple Ways to Pay The Leading Specialized Payments Platform Connected to ~75% of operators in the U.S. and 100% of Canadian iLotteries ~40% of revenue in fast growing and emerging verticals Management with 300+ deal closing experience ~70% of revenue on our single-stack Unity platform VISION The Global Leader in iGaming Growing Digital Commerce in Attractive Verticals Positioned to Win in Market Consolidation Driving Global Scale

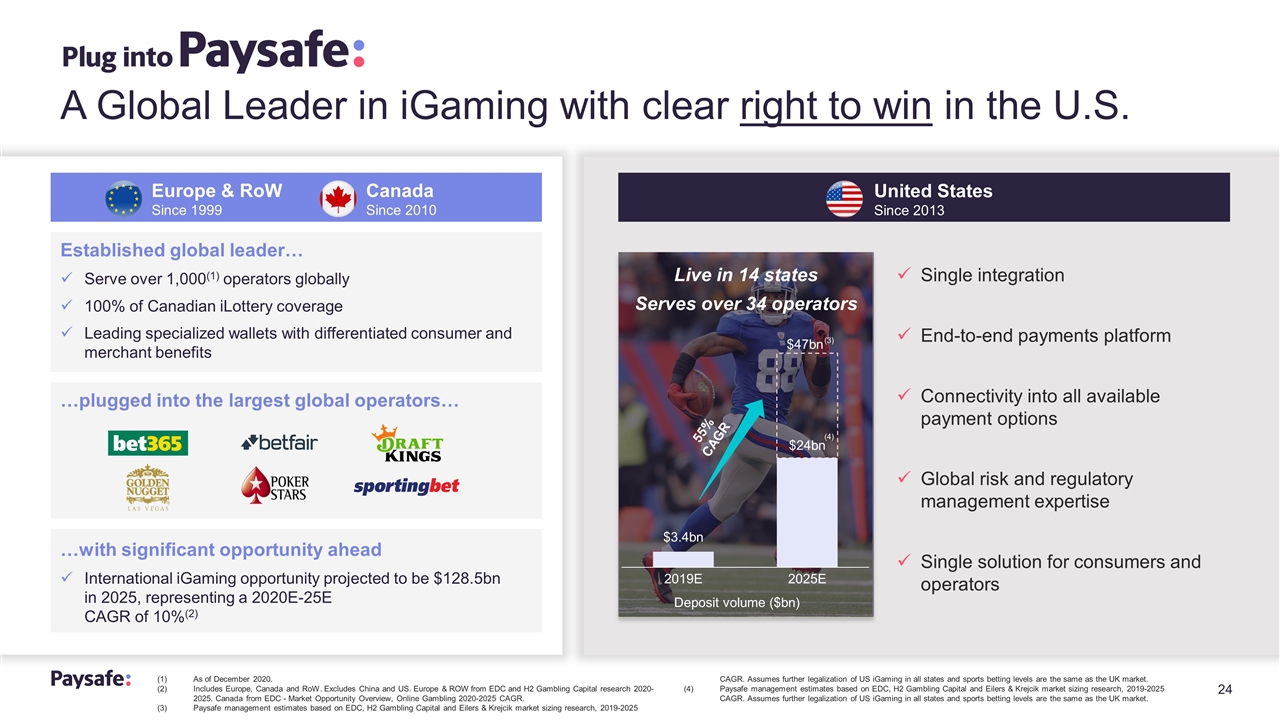

Europe & RoW Since 1999 Canada Since 2010 Single integration End-to-end payments platform Connectivity into all available payment options Global risk and regulatory management expertise Single solution for consumers and operators United States Since 2013 Deposit volume ($bn) $47bn 55% CAGR (3) (4) Live in 14 states Serves over 34 operators Established global leader… Serve over 1,000(1) operators globally 100% of Canadian iLottery coverage Leading specialized wallets with differentiated consumer and merchant benefits …plugged into the largest global operators… …with significant opportunity ahead International iGaming opportunity projected to be $128.5bn in 2025, representing a 2020E-25E CAGR of 10%(2) A Global Leader in iGaming with clear right to win in the U.S. (1)As of December 2020. (2)Includes Europe, Canada and RoW. Excludes China and US. Europe & ROW from EDC and H2 Gambling Capital research 2020-2025. Canada from EDC - Market Opportunity Overview, Online Gambling 2020-2025 CAGR. (3) Paysafe management estimates based on EDC, H2 Gambling Capital and Eilers & Krejcik market sizing research, 2019-2025 CAGR. Assumes further legalization of US iGaming in all states and sports betting levels are the same as the UK market. (4) Paysafe management estimates based on EDC, H2 Gambling Capital and Eilers & Krejcik market sizing research, 2019-2025 CAGR. Assumes further legalization of US iGaming in all states and sports betting levels are the same as the UK market.

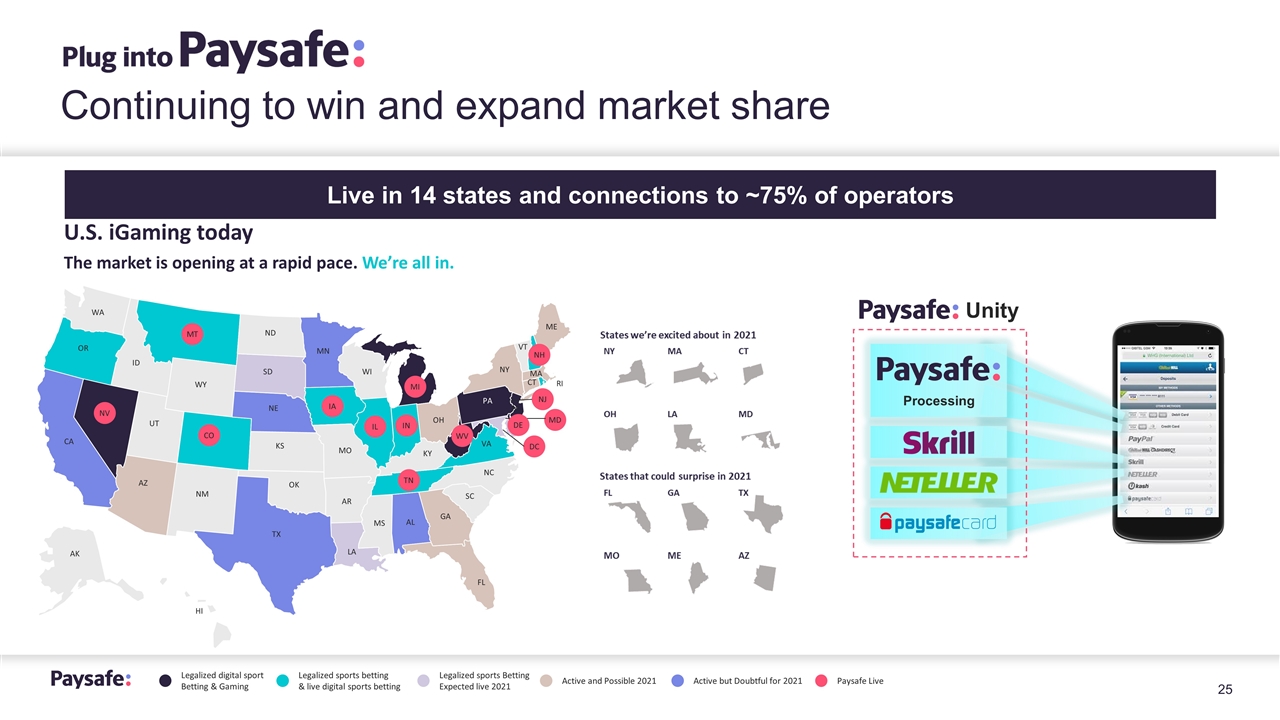

Continuing to win and expand market share Live in 14 states and connections to ~75% of operators U.S. iGaming today The market is opening at a rapid pace. We’re all in. Legalized digital sport Betting & Gaming Legalized sports betting & live digital sports betting Legalized sports Betting Expected live 2021 Active and Possible 2021 Active but Doubtful for 2021 Paysafe Live MA WA ID CA OR AZ CO NM UT WY TX KS OK MN NE ND SD WI MS AL AR KY LA MO FL GA NC SC OH CT ME MI NY PA VT NJ RI VA NV MT IA IL IN TN WV NJ DC MD NH DE AK HI CO MI States that could surprise in 2021 MO ME AZ States we’re excited about in 2021 OH LA MD NY MA CT FL GA TX Processing Unity

Already live in 14 states and connected to ~75% of U.S. operators Stellar reputation and industry experience Deep understanding of what both operators and consumers require to be successful COVID-19 accelerating regulation and we are positioned in emerging states with leading operators Dedicated team solely focused on U.S. market Purpose-built U.S. centric suite of products for new users and VIPs Unity provides a new end-to-end payment platform and gateway that delivers: Single integration into leading payment methods and acquiring backend Risk and regulatory management expertise Single solution for consumers and operators Trusted and credible partner with wallet integrations into major global players and leading APMs Our right to win in the U.S. Leveraging the Paysafe Playbook to win in U.S. iGaming

iGaming Digital Goods Travel & Entertainment Integrated Payments FinTech Services TAM Right to Win in valuable verticals $80bn+(1) $500bn+(3) $1.5tn+(2) $2.2tn+(5) $2.9tn+(4) Note:TAM reflects 2020E volumes except iGaming. (1)Represents deposit volumes. EDC and H2 Gambling Capital research 2020-2025. Excludes China and for US iGaming Paysafe management estimates based on EDC, H2 Gambling Capital and Eilers& Krejcikmarket sizing research. Assumes certain further legalization of US iGaming. (2)Euromonitor and Grandview Market Research. (3) Newzoo 2019 global gaming report, EDC market analysis and annual reports and Wall Street Research of Amazon, Apple, Google, Facebook, Netflix, Spotify. (4)Management estimates based on EDC, BIS, WFOE, Forbes, Visual Capitalist, Deutsche Borse Group, ESMA, Deutsche Bank WorldPay, Allied Market Research, reportsanddata.com, Challenger Bank investor presentations and company financial statements / annual reports. (5)Glenbrook, Strawhecker TSG, IBIS, EDC and relevant annual reports from companies in the sector.

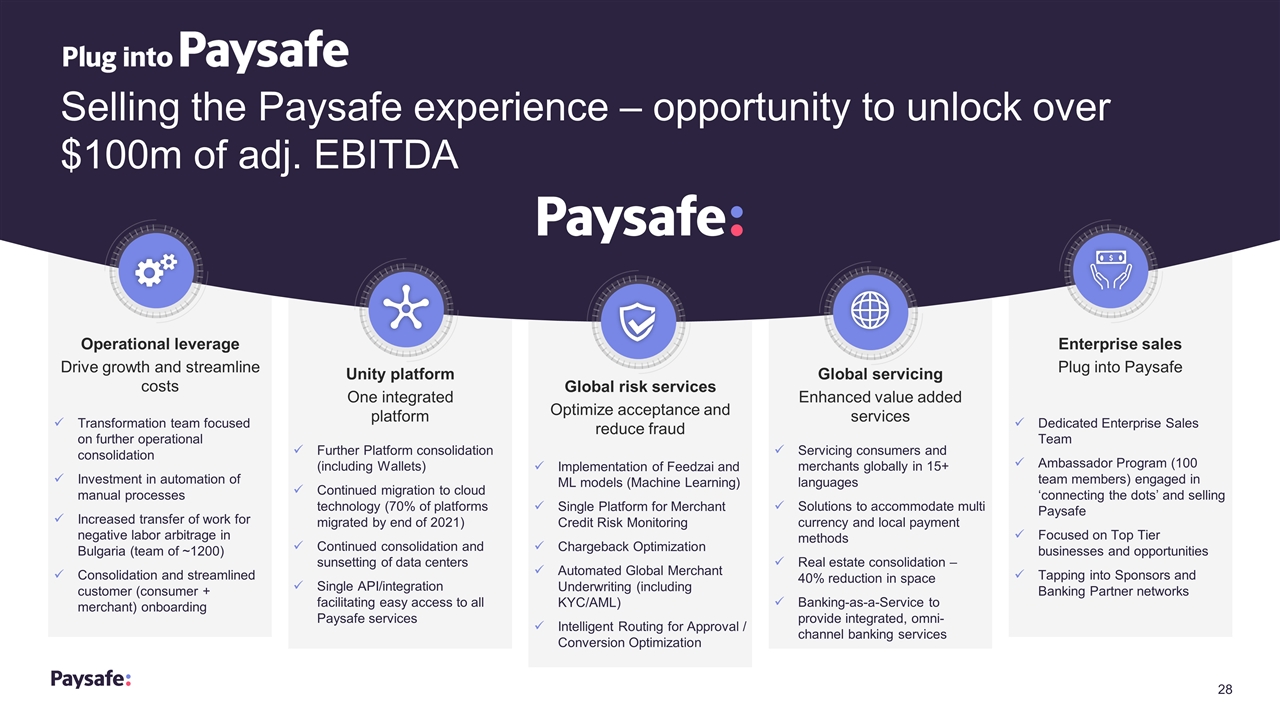

Operational leverage Drive growth and streamline costs Enterprise sales Plug into Paysafe Unity platform One integrated platform Global servicing Enhanced value added services Global risk services Optimize acceptance and reduce fraud Transformation team focused on further operational consolidation Investment in automation of manual processes Increased transfer of work for negative labor arbitrage in Bulgaria (team of ~1200) Consolidation and streamlined customer (consumer + merchant) onboarding Further Platform consolidation (including Wallets) Continued migration to cloud technology (70% of platforms migrated by end of 2021) Continued consolidation and sunsetting of data centers Single API/integration facilitating easy access to all Paysafe services Implementation of Feedzai and ML models (Machine Learning) Single Platform for Merchant Credit Risk Monitoring Chargeback Optimization Automated Global Merchant Underwriting (including KYC/AML) Intelligent Routing for Approval / Conversion Optimization Servicing consumers and merchants globally in 15+ languages Solutions to accommodate multi currency and local payment methods Real estate consolidation – 40% reduction in space Banking-as-a-Service to provide integrated, omni-channel banking services Dedicated Enterprise Sales Team Ambassador Program (100 team members) engaged in ‘connecting the dots’ and selling Paysafe Focused on Top Tier businesses and opportunities Tapping into Sponsors and Banking Partner networks Selling the Paysafe experience – opportunity to unlock over $100m of adj. EBITDA

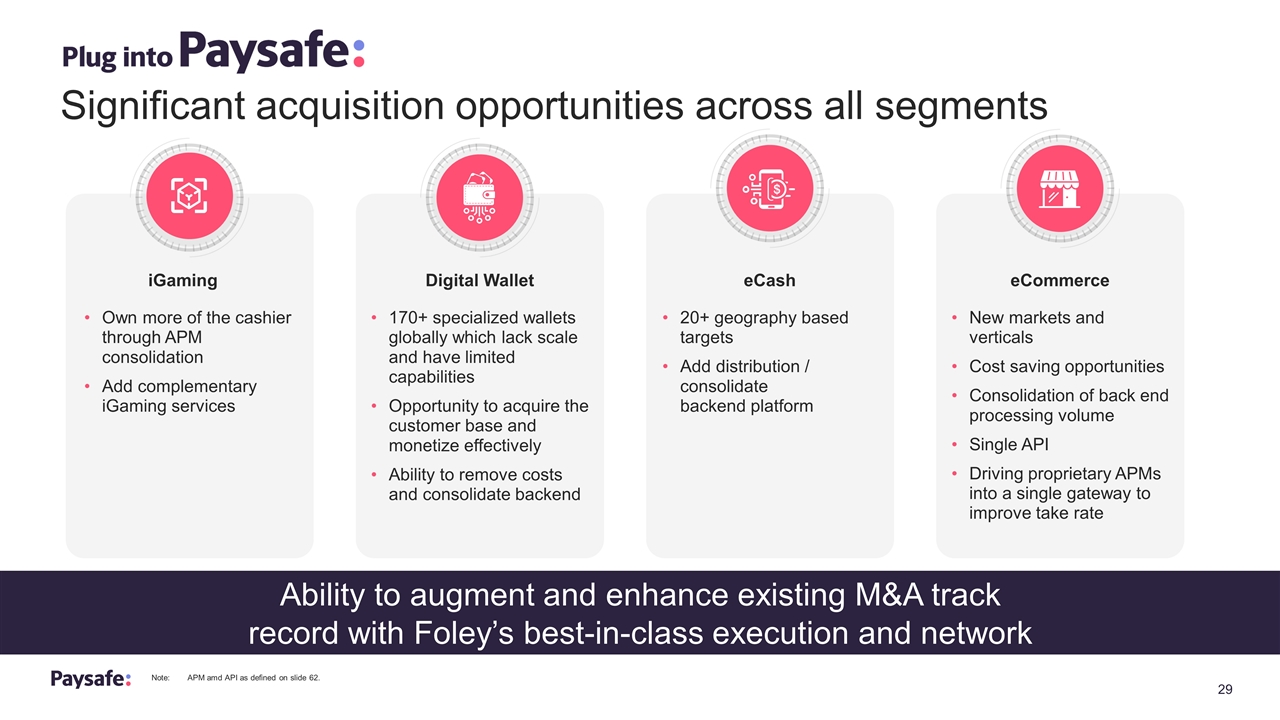

Note:APM amd API as defined on slide 62. Ability to augment and enhance existing M&A track record with Foley’s best-in-class execution and network eCommerce iGaming Own more of the cashier through APM consolidation Add complementary iGaming services Digital Wallet 170+ specialized wallets globally which lack scale and have limited capabilities Opportunity to acquire the customer base and monetize effectively Ability to remove costs and consolidate backend eCash 20+ geography based targets Add distribution / consolidate backend platform New markets and verticals Cost saving opportunities Consolidation of back end processing volume Single API Driving proprietary APMs into a single gateway to improve take rate Significant acquisition opportunities across all segments

4. Financial overview

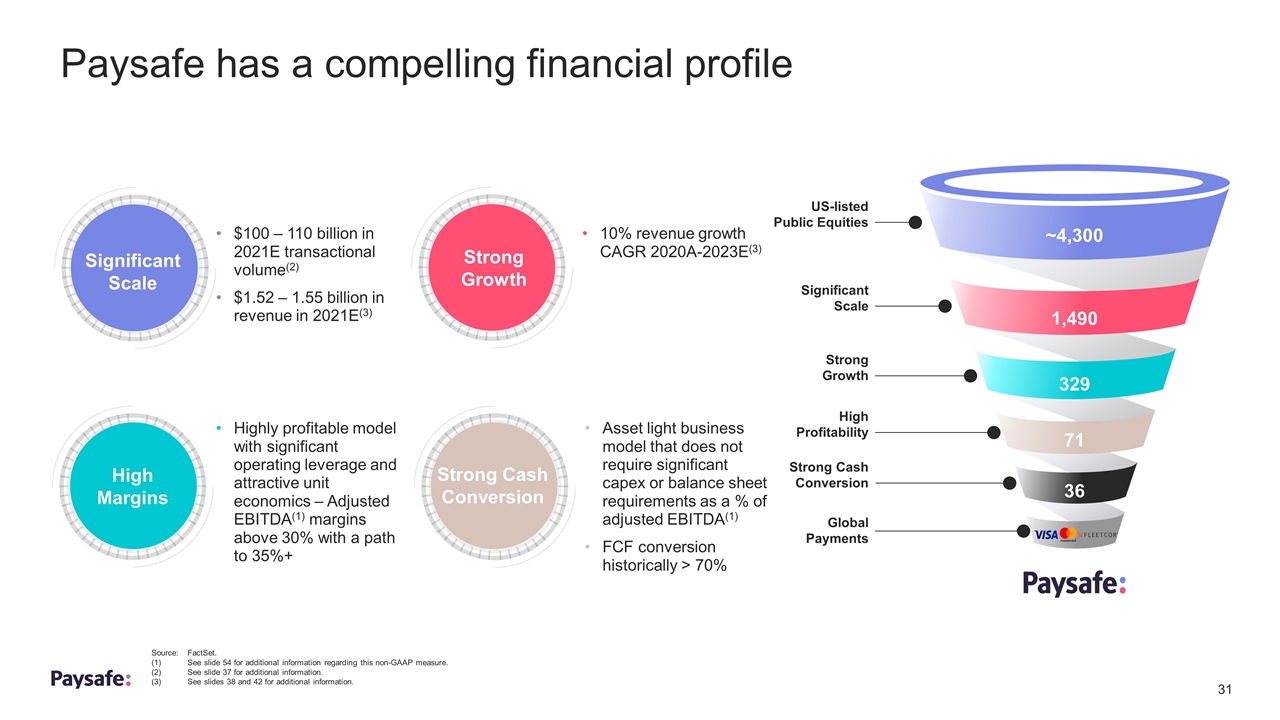

Paysafe has a compelling financial profile Significant Scale Strong Growth High Margins Strong Cash Conversion $100 – 110 billion in 2021E transactional volume(2) $1.52 – 1.55 billion in revenue in 2021E(3) 10% revenue growth CAGR 2020A-2023E(3) Highly profitable model with significant operating leverage and attractive unit economics – Adjusted EBITDA(1) margins above 30% with a path to 35%+ Asset light business model that does not require significant capex or balance sheet requirements as a % of adjusted EBITDA(1) FCF conversion historically > 70% US-listed Public Equities Significant Scale Strong Growth High Profitability Strong Cash Conversion Global Payments ~4,300 1,490 329 71 36 Source:FactSet. (1)See slide 54 for additional information regarding this non-GAAP measure. (2)See slide 37 for additional information. (3)See slides 38 and 42 for additional information.

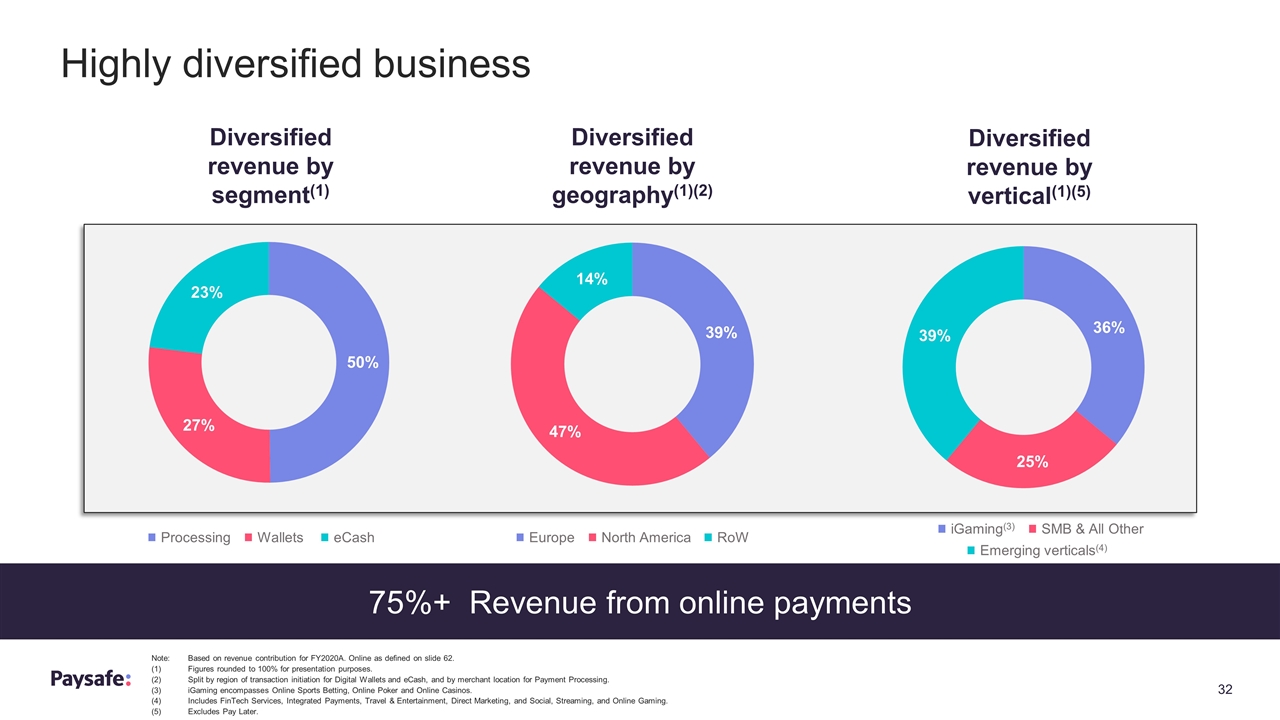

Highly diversified business Note: Based on revenue contribution for FY2020A. Online as defined on slide 62. (1)Figures rounded to 100% for presentation purposes. (2)Split by region of transaction initiation for Digital Wallets and eCash, and by merchant location for Payment Processing. (3)iGaming encompasses Online Sports Betting, Online Poker and Online Casinos. (4) Includes FinTech Services, Integrated Payments, Travel & Entertainment, Direct Marketing, and Social, Streaming, and Online Gaming. (5)Excludes Pay Later. Diversified revenue by segment(1) Diversified revenue by geography(1)(2) Diversified revenue by vertical(1)(5) 75%+ Revenue from online payments Processing Wallets eCash Europe North America RoW iGaming(3) SMB & All Other Emerging verticals(4)

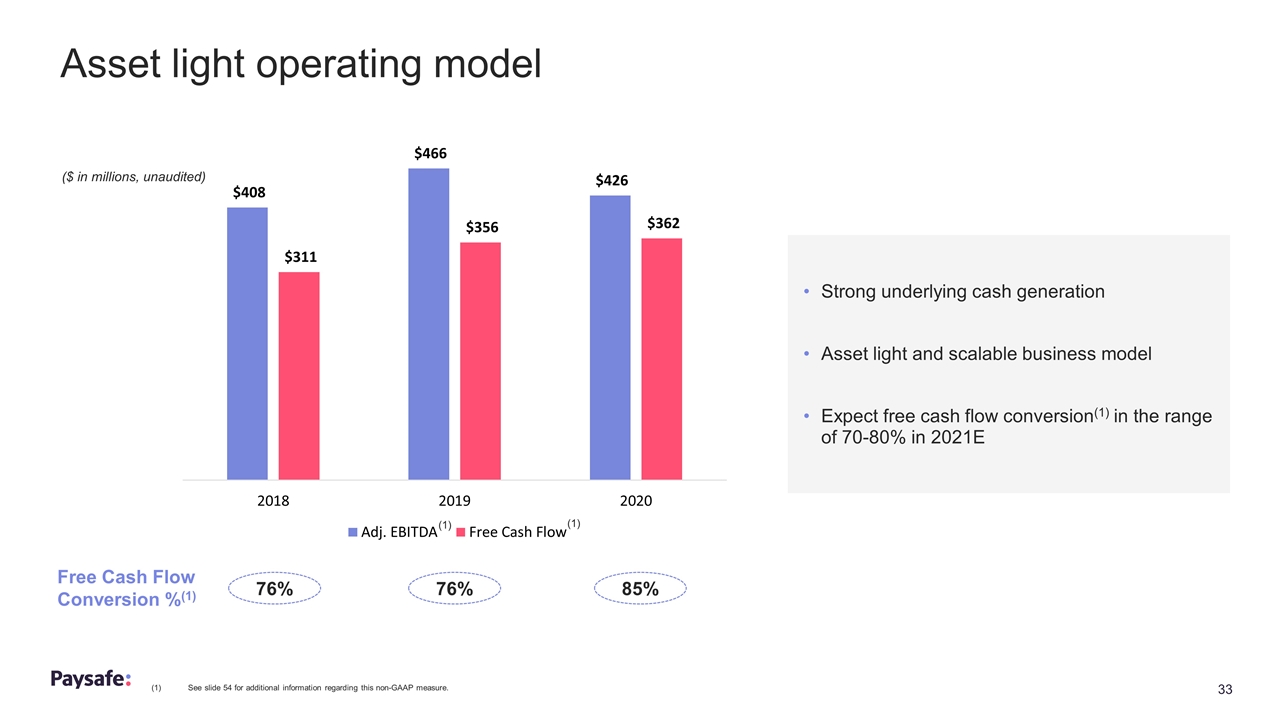

Asset light operating model Free Cash Flow Conversion %(1) 76% 76% 85% Strong underlying cash generation Asset light and scalable business model Expect free cash flow conversion(1) in the range of 70-80% in 2021E (1) See slide 54 for additional information regarding this non-GAAP measure. (1) (1) ($ in millions, unaudited)

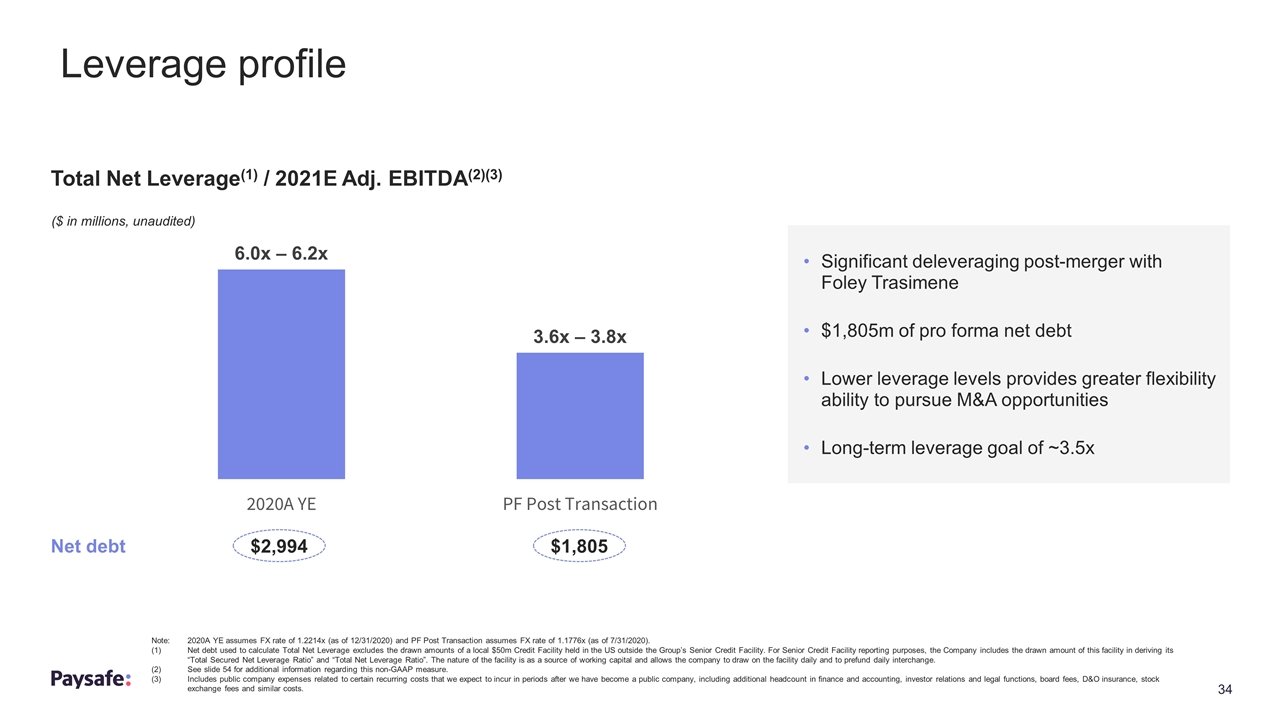

Leverage profile Total Net Leverage(1) / 2021E Adj. EBITDA(2)(3) Significant deleveraging post-merger with Foley Trasimene $1,805m of pro forma net debt Lower leverage levels provides greater flexibility ability to pursue M&A opportunities Long-term leverage goal of ~3.5x $1,805 Net debt ($ in millions, unaudited) $2,994 Note: 2020A YE assumes FX rate of 1.2214x (as of 12/31/2020) and PF Post Transaction assumes FX rate of 1.1776x (as of 7/31/2020). (1) Net debt used to calculate Total Net Leverage excludes the drawn amounts of a local $50m Credit Facility held in the US outside the Group’s Senior Credit Facility. For Senior Credit Facility reporting purposes, the Company includes the drawn amount of this facility in deriving its “Total Secured Net Leverage Ratio” and “Total Net Leverage Ratio”. The nature of the facility is as a source of working capital and allows the company to draw on the facility daily and to prefund daily interchange. (2) See slide 54 for additional information regarding this non-GAAP measure. (3) Includes public company expenses related to certain recurring costs that we expect to incur in periods after we have become a public company, including additional headcount in finance and accounting, investor relations and legal functions, board fees, D&O insurance, stock exchange fees and similar costs.

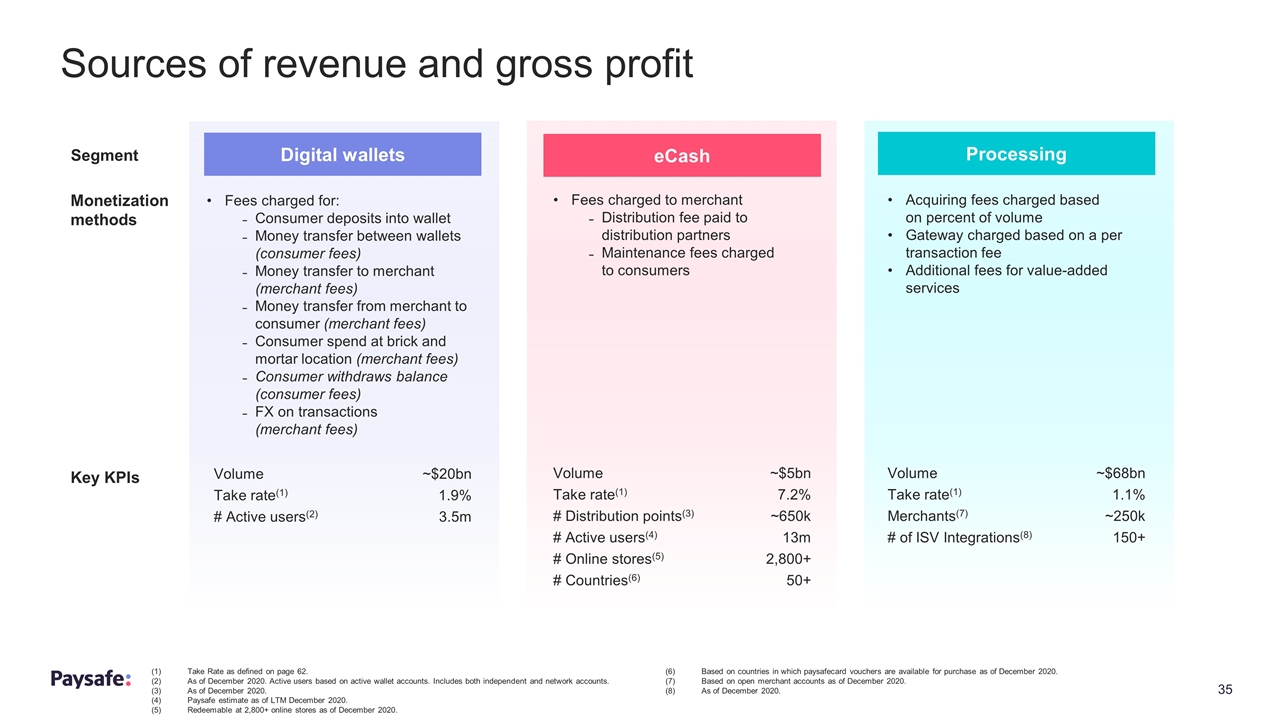

Sources of revenue and gross profit (1)Take Rate as defined on page 62. (2)As of December 2020. Active users based on active wallet accounts. Includes both independent and network accounts. (3)As of December 2020. (4)Paysafe estimate as of LTM December 2020. (5)Redeemable at 2,800+ online stores as of December 2020. (6)Based on countries in which paysafecard vouchers are available for purchase as of December 2020. (7)Based on open merchant accounts as of December 2020. (8)As of December 2020. Digital wallets eCash Processing Fees charged for: Consumer deposits into wallet Money transfer between wallets (consumer fees) Money transfer to merchant (merchant fees) Money transfer from merchant to consumer (merchant fees) Consumer spend at brick and mortar location (merchant fees) Consumer withdraws balance (consumer fees) FX on transactions (merchant fees) Fees charged to merchant Distribution fee paid to distribution partners Maintenance fees charged to consumers Acquiring fees charged based on percent of volume Gateway charged based on a per transaction fee Additional fees for value-added services Volume ~$5bn Take rate(1) 7.2% # Distribution points(3) ~650k # Active users(4) 13m # Online stores(5) 2,800+ # Countries(6) 50+ Volume ~$68bn Take rate(1) 1.1% Merchants(7) ~250k # of ISV Integrations(8) 150+ Volume ~$20bn Take rate(1) 1.9% # Active users(2) 3.5m Segment Monetization methods Key KPIs

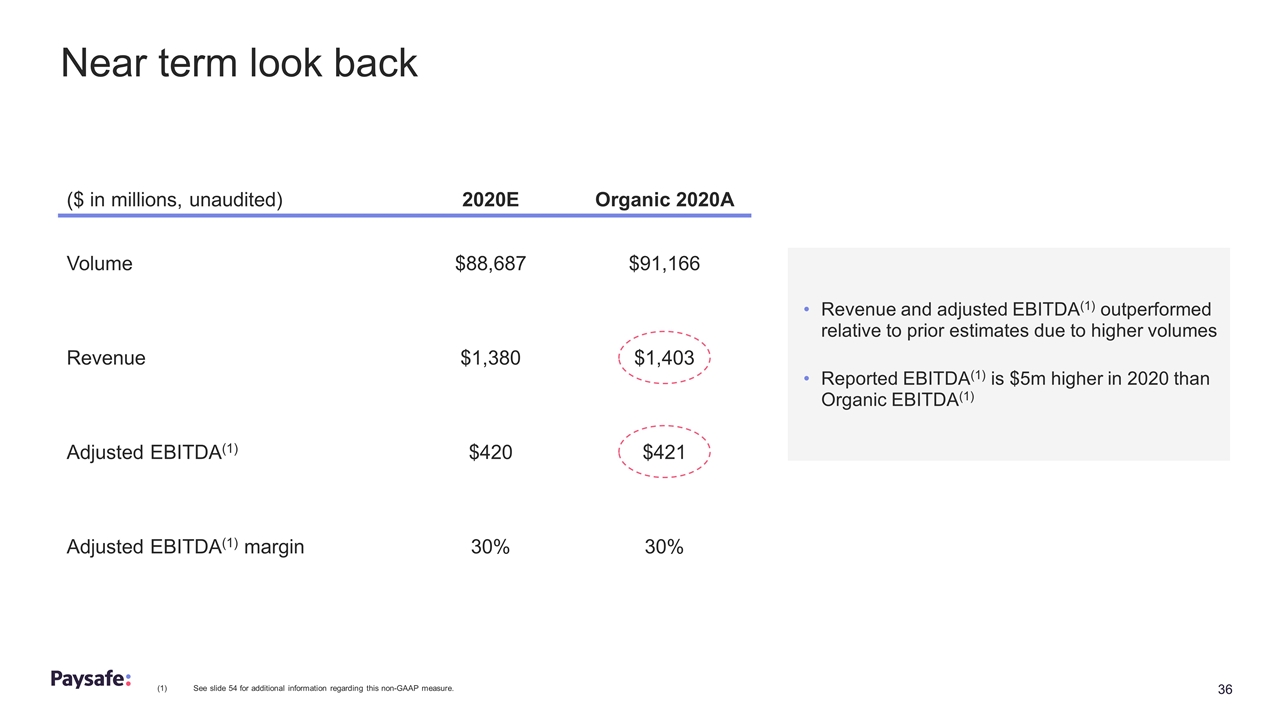

Near term look back ($ in millions, unaudited) 2020E Organic 2020A Volume $88,687 $91,166 Revenue $1,380 $1,403 Adjusted EBITDA(1) $420 $421 Adjusted EBITDA(1) margin 30% 30% (1)See slide 54 for additional information regarding this non-GAAP measure. Revenue and adjusted EBITDA(1) outperformed relative to prior estimates due to higher volumes Reported EBITDA(1) is $5m higher in 2020 than Organic EBITDA(1)

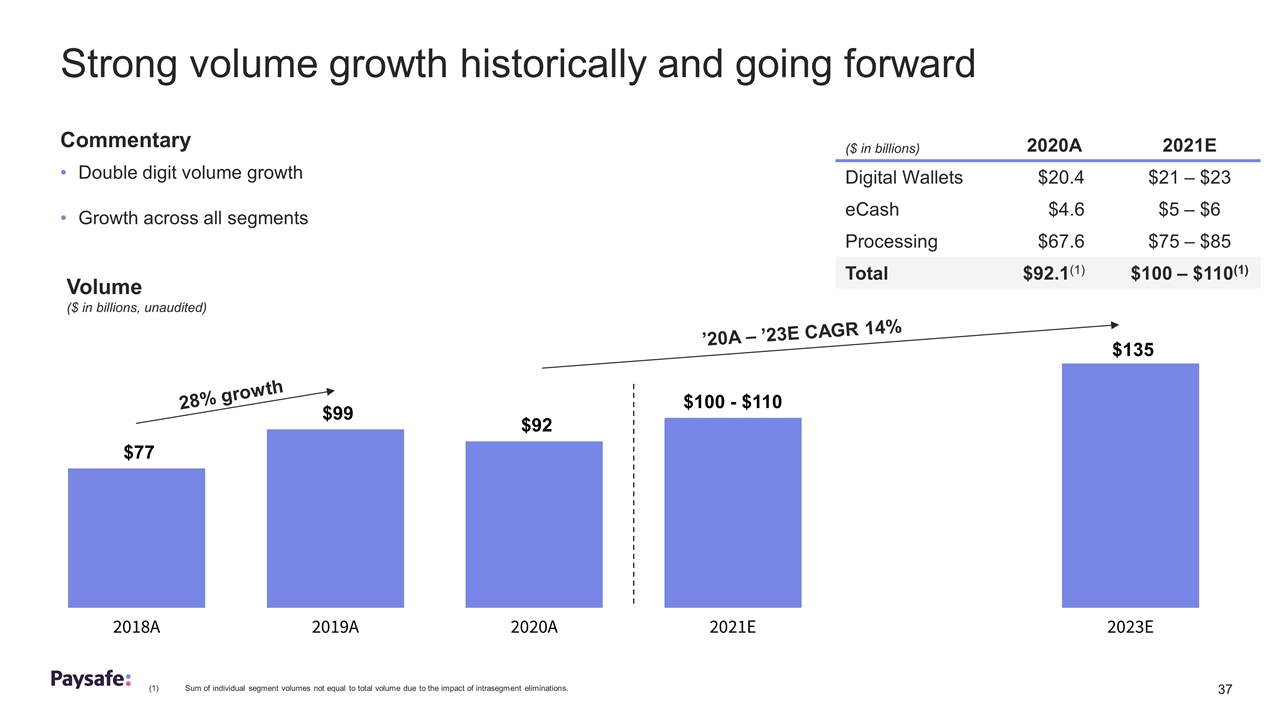

Strong volume growth historically and going forward Volume ($ in billions, unaudited) Double digit volume growth Growth across all segments Commentary ’20A – ’23E CAGR 14% 28% growth (1)Sum of individual segment volumes not equal to total volume due to the impact of intrasegment eliminations. ($ in billions) 2020A 2021E Digital Wallets $20.4 $21 – $23 eCash $4.6 $5 – $6 Processing $67.6 $75 – $85 Total $92.1(1) $100 – $110(1)

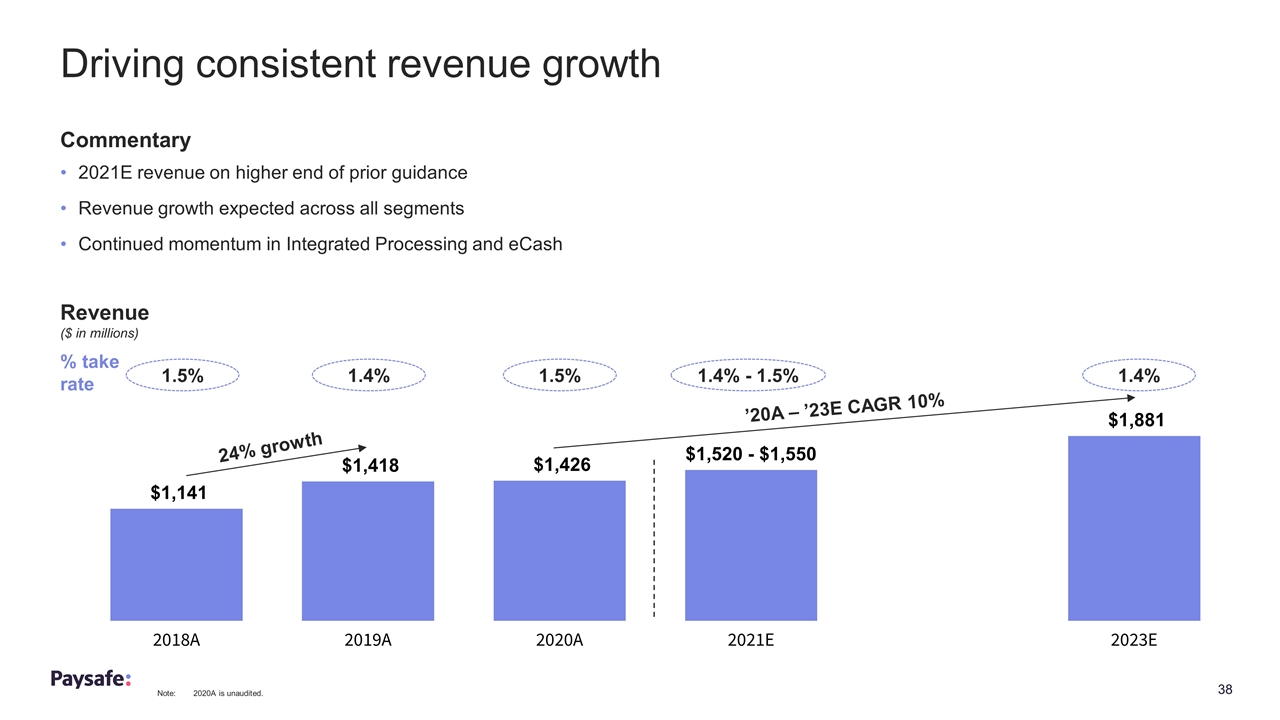

Driving consistent revenue growth Revenue ($ in millions) 2021E revenue on higher end of prior guidance Revenue growth expected across all segments Continued momentum in Integrated Processing and eCash Commentary ’20A – ’23E CAGR 10% 24% growth 1.4% 1.5% 1.5% 1.4% % take rate 1.4% - 1.5% Note:2020A is unaudited.

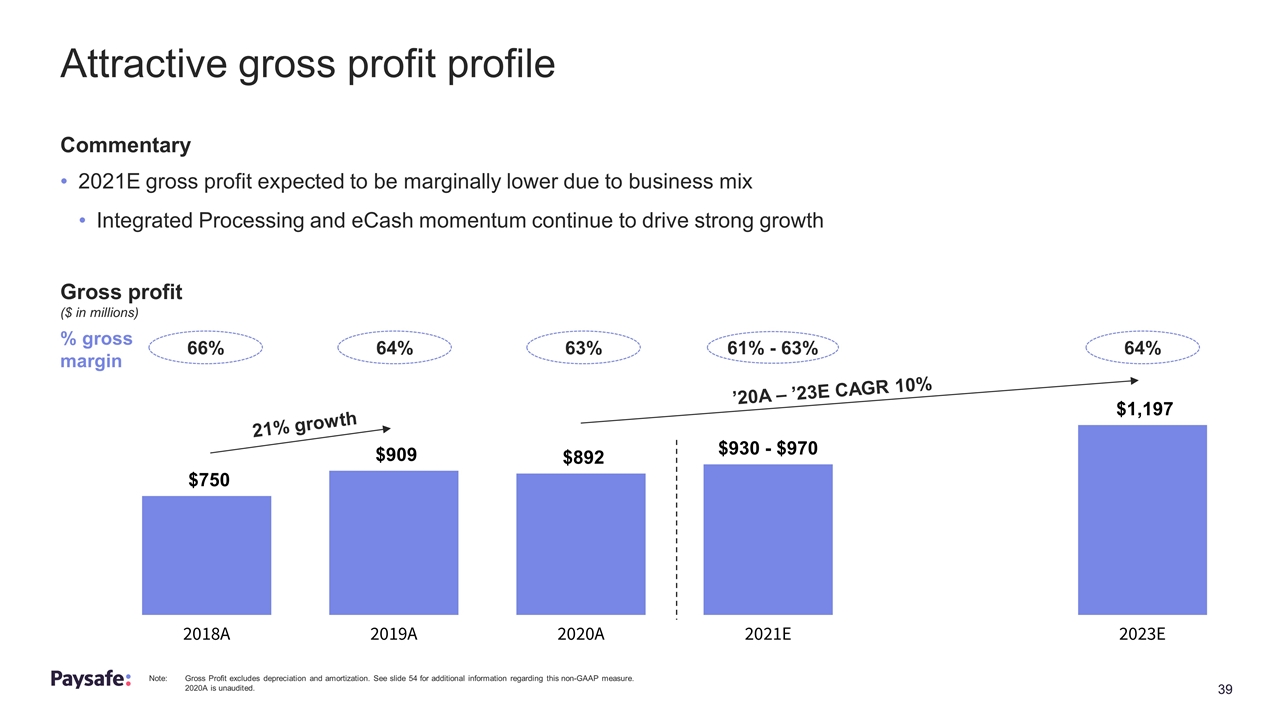

Attractive gross profit profile Gross profit ($ in millions) 2021E gross profit expected to be marginally lower due to business mix Integrated Processing and eCash momentum continue to drive strong growth Commentary 21% growth 64% 63% 66% 64% % gross margin ’20A – ’23E CAGR 10% 61% - 63% Note:Gross Profit excludes depreciation and amortization. See slide 54 for additional information regarding this non-GAAP measure. 2020A is unaudited.

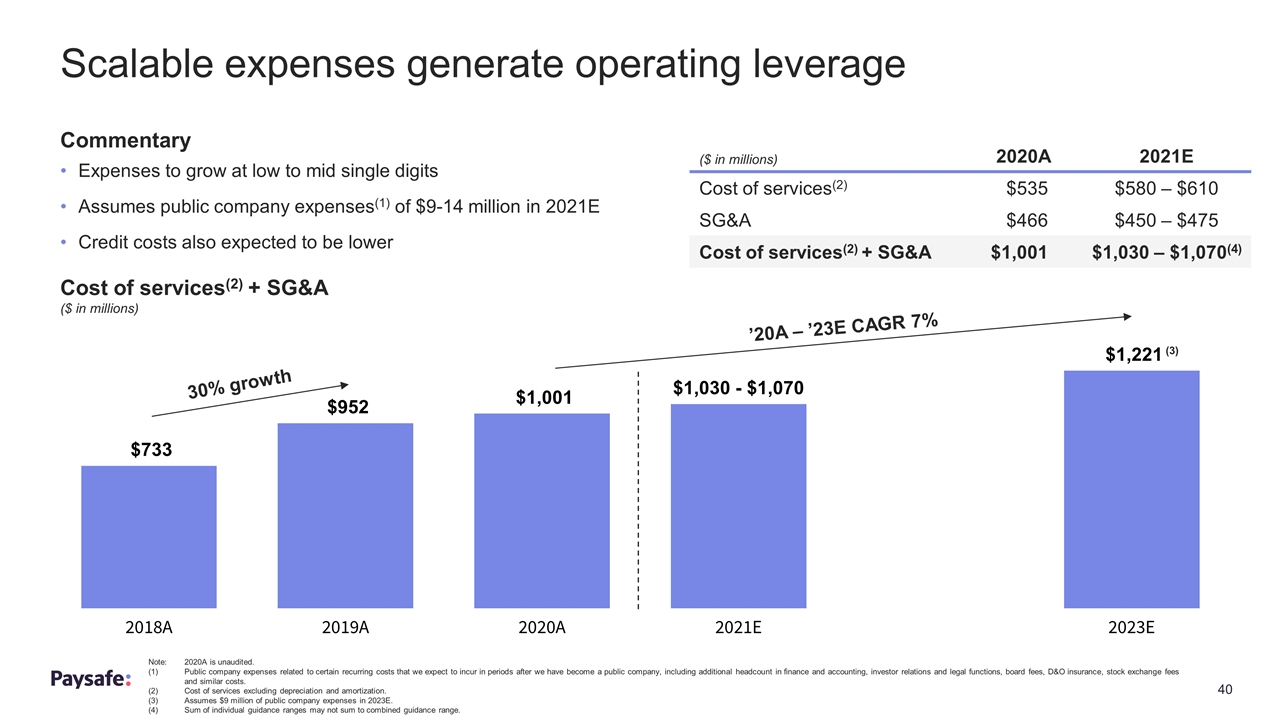

Scalable expenses generate operating leverage Expenses to grow at low to mid single digits Assumes public company expenses(1) of $9-14 million in 2021E Credit costs also expected to be lower Commentary Cost of services(2) + SG&A ($ in millions) ’20A – ’23E CAGR 7% 30% growth Note:2020A is unaudited. (1)Public company expenses related to certain recurring costs that we expect to incur in periods after we have become a public company, including additional headcount in finance and accounting, investor relations and legal functions, board fees, D&O insurance, stock exchange fees and similar costs. (2)Cost of services excluding depreciation and amortization. (3)Assumes $9 million of public company expenses in 2023E. (4)Sum of individual guidance ranges may not sum to combined guidance range. (3) ($ in millions) 2020A 2021E Cost of services(2) $535 $580 – $610 SG&A $466 $450 – $475 Cost of services(2) + SG&A $1,001 $1,030 – $1,070(4)

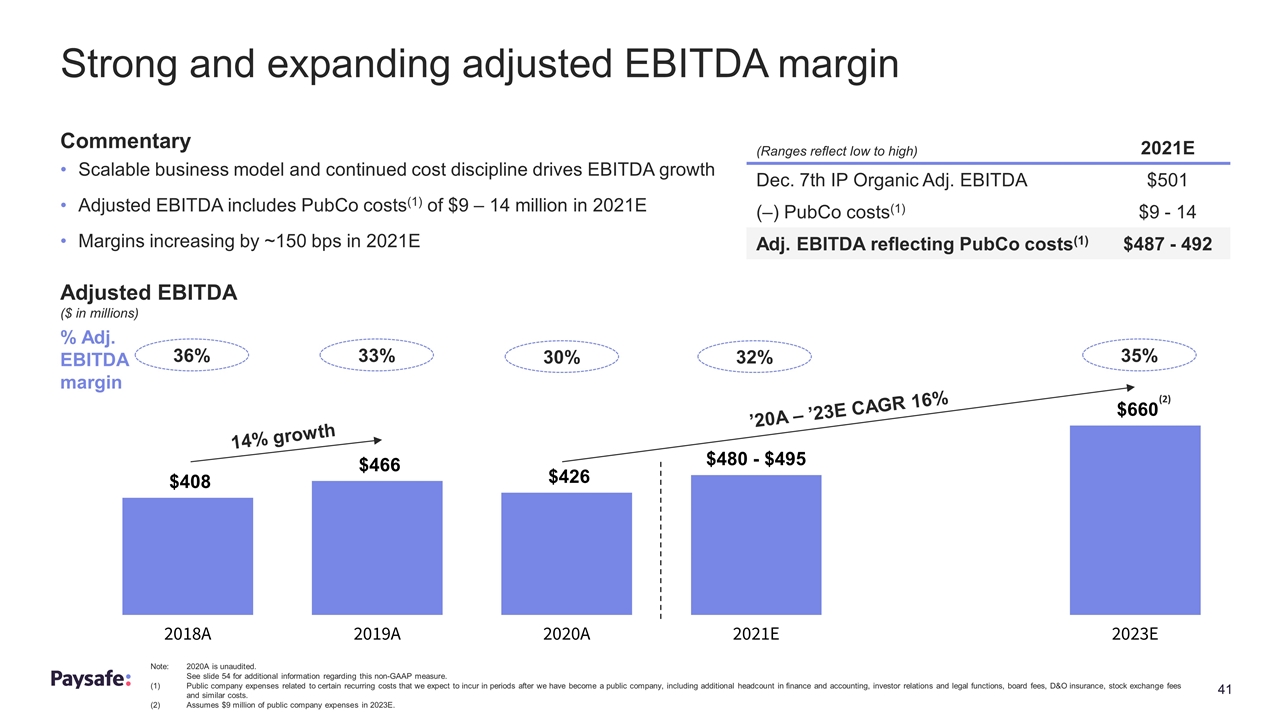

Strong and expanding adjusted EBITDA margin Adjusted EBITDA ($ in millions) Scalable business model and continued cost discipline drives EBITDA growth Adjusted EBITDA includes PubCo costs(1) of $9 – 14 million in 2021E Margins increasing by ~150 bps in 2021E Commentary 14% growth % Adj. EBITDA margin ’20A – ’23E CAGR 16% 33% 30% 36% 35% 32% (2) Note:2020A is unaudited. See slide 54 for additional information regarding this non-GAAP measure. (1)Public company expenses related to certain recurring costs that we expect to incur in periods after we have become a public company, including additional headcount in finance and accounting, investor relations and legal functions, board fees, D&O insurance, stock exchange fees and similar costs. (2)Assumes $9 million of public company expenses in 2023E. (Ranges reflect low to high) 2021E Dec. 7th IP Organic Adj. EBITDA $501 (–) PubCo costs(1) $9 - 14 Adj. EBITDA reflecting PubCo costs(1) $487 - 492

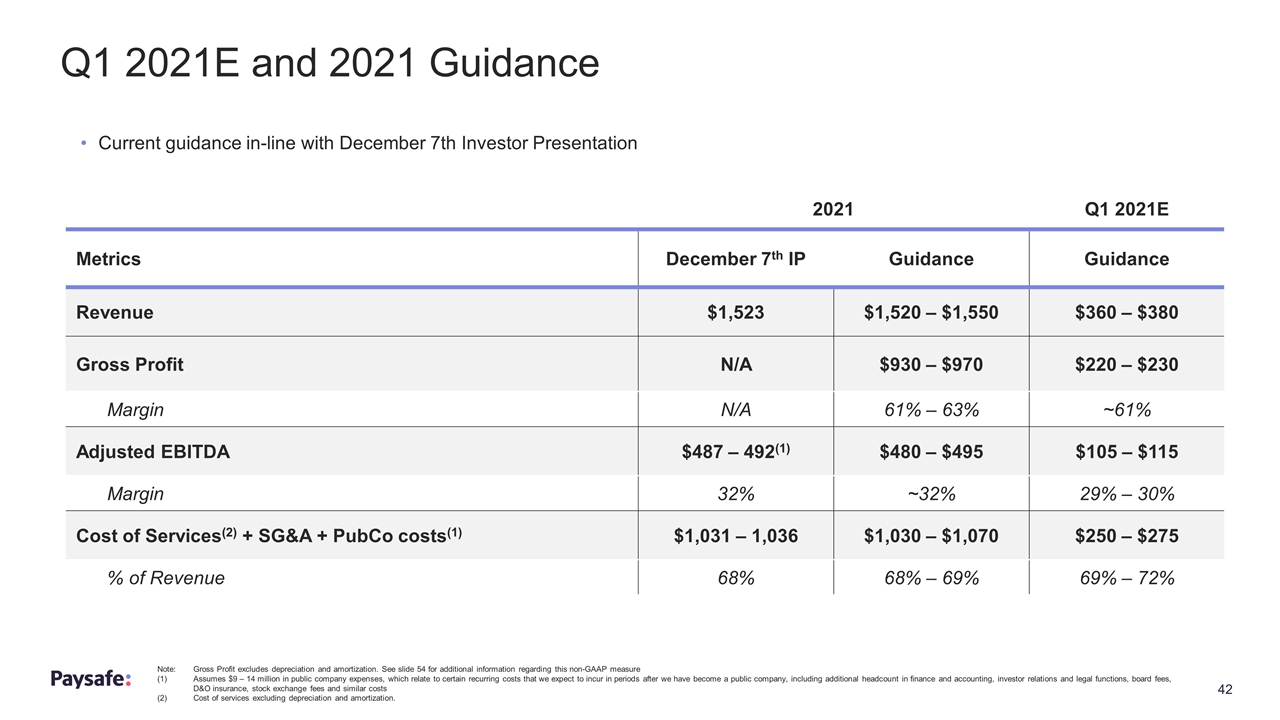

Q1 2021E and 2021 Guidance 2021 Q1 2021E Metrics December 7th IP Guidance Guidance Revenue $1,523 $1,520 – $1,550 $360 – $380 Gross Profit N/A $930 – $970 $220 – $230 Margin N/A 61% – 63% ~61% Adjusted EBITDA $487 – 492(1) $480 – $495 $105 – $115 Margin 32% ~32% 29% – 30% Cost of Services(2) + SG&A + PubCo costs(1) $1,031 – 1,036 $1,030 – $1,070 $250 – $275 % of Revenue 68% 68% – 69% 69% – 72% Note: Gross Profit excludes depreciation and amortization. See slide 54 for additional information regarding this non-GAAP measure (1)Assumes $9 – 14 million in public company expenses, which relate to certain recurring costs that we expect to incur in periods after we have become a public company, including additional headcount in finance and accounting, investor relations and legal functions, board fees, D&O insurance, stock exchange fees and similar costs (2)Cost of services excluding depreciation and amortization. Current guidance in-line with December 7th Investor Presentation

Consistent strong top- and bottom-line organic growth Positioned well for market consolidation Potential to double or triple the Company size over the near to medium term The Leading Specialized Payments Platform VISION Sports betting Online casino Lottery eSports Fantasy sports History Team Platforms Operational leverage Unity platform Global risk services Global servicing Enterprise sales Digital goods Fintech services Travel & entertainment Integrated verticals The Global Leader in iGaming Growing Digital Commerce in Attractive Verticals Positioned to Win in Market Consolidation Driving Global Scale

Q&A

Appendix

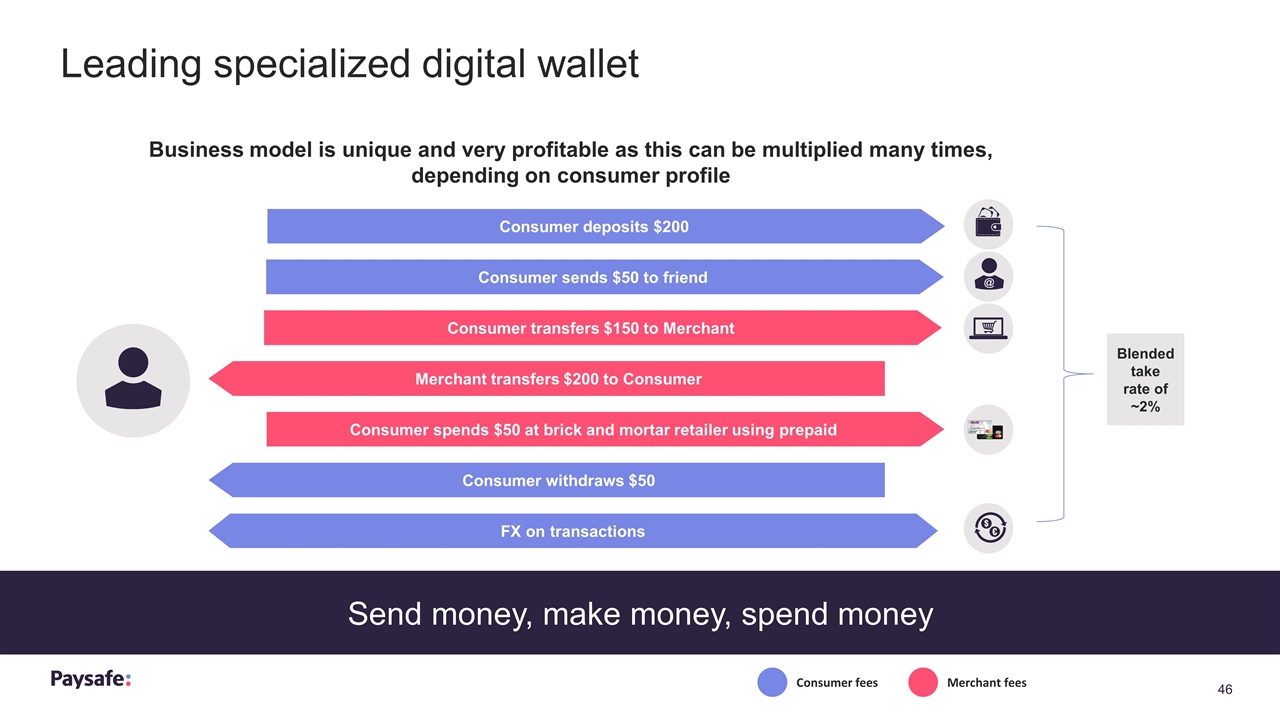

Leading specialized digital wallet Consumer fees Merchant fees Blended take rate of ~2% Business model is unique and very profitable as this can be multiplied many times, depending on consumer profile Consumer transfers $150 to Merchant Merchant transfers $200 to Consumer FX on transactions Consumer deposits $200 Consumer sends $50 to friend Consumer spends $50 at brick and mortar retailer using prepaid Consumer withdraws $50 Send money, make money, spend money

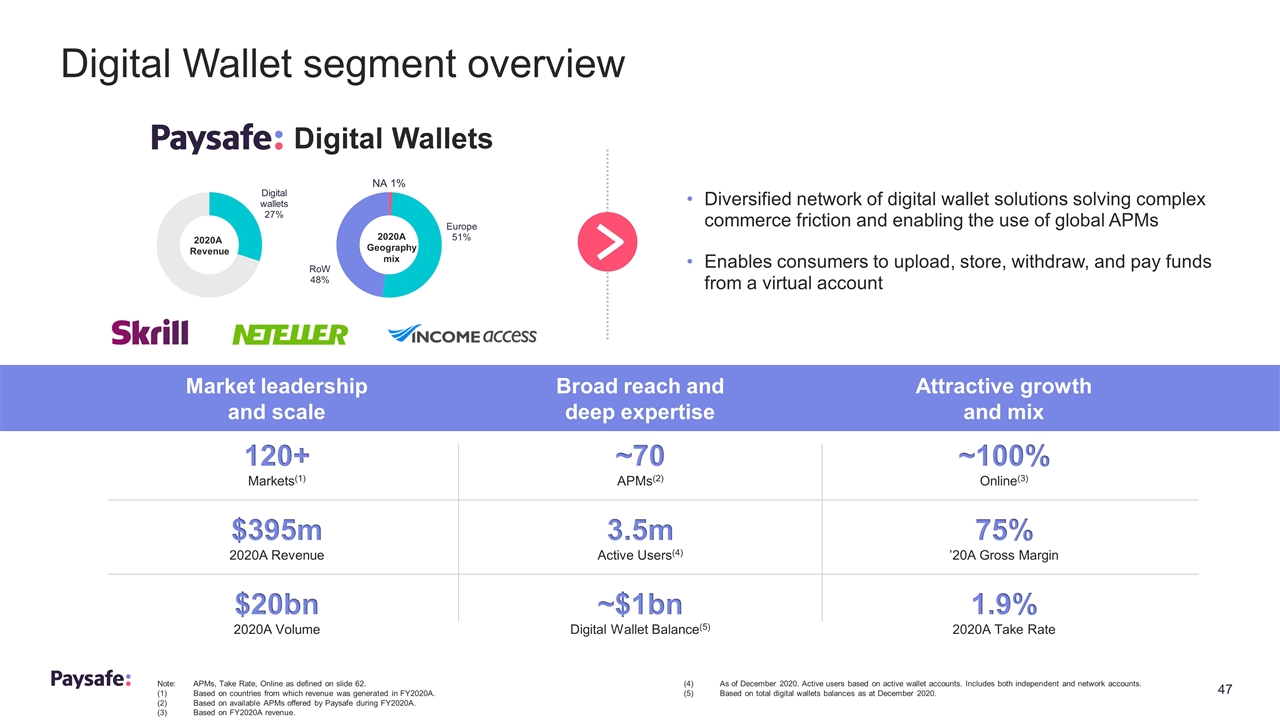

Digital Wallet segment overview $20bn 2020A Volume $395m 2020A Revenue 120+ Markets(1) 1.9% 2020A Take Rate 75% ’20A Gross Margin ~100% Online(3) ~$1bn Digital Wallet Balance(5) 3.5m Active Users(4) ~70 APMs(2) Market leadership and scale Attractive growth and mix Broad reach and deep expertise Diversified network of digital wallet solutions solving complex commerce friction and enabling the use of global APMs Enables consumers to upload, store, withdraw, and pay funds from a virtual account Digital Wallets Note:APMs, Take Rate, Online as defined on slide 62. (1)Based on countries from which revenue was generated in FY2020A. (2)Based on available APMs offered by Paysafe during FY2020A. (3)Based on FY2020A revenue. (4)As of December 2020. Active users based on active wallet accounts. Includes both independent and network accounts. (5)Based on total digital wallets balances as at December 2020.

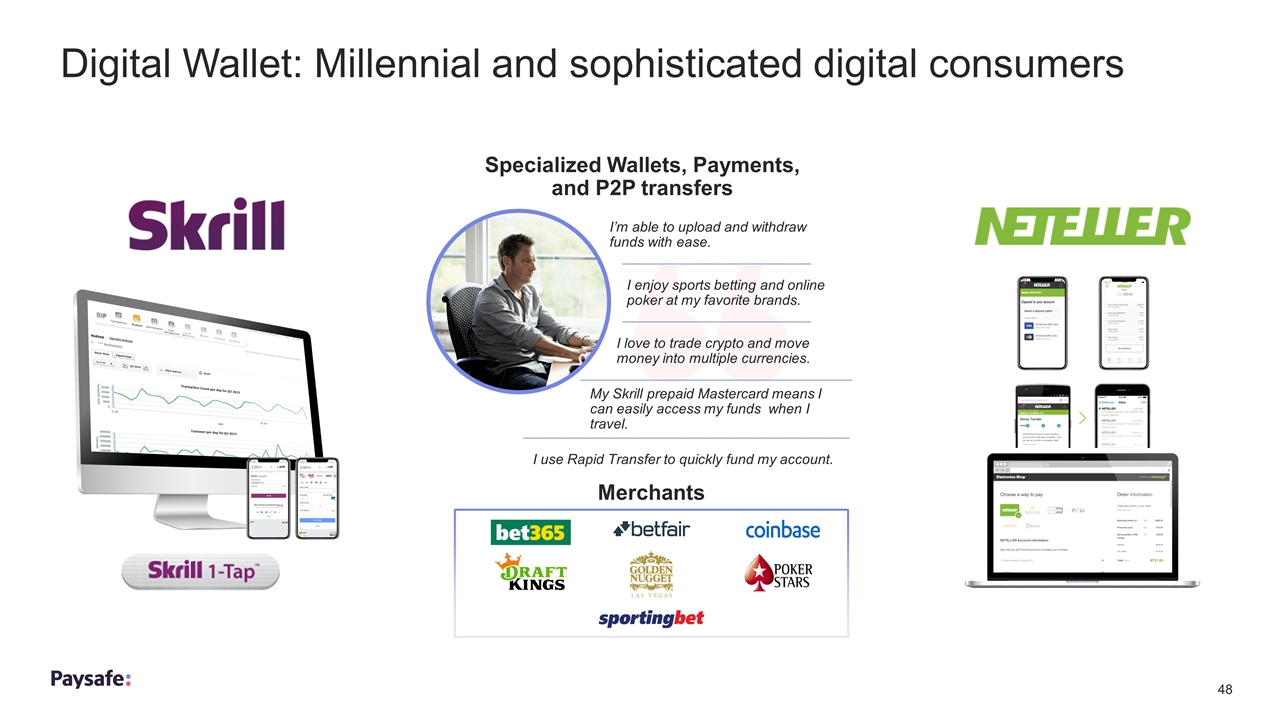

Digital Wallet: Millennial and sophisticated digital consumers Specialized Wallets, Payments, and P2P transfers I love to trade crypto and move money into multiple currencies. I enjoy sports betting and online poker at my favorite brands. My Skrill prepaid Mastercard means I can easily access my funds when I travel. I’m able to upload and withdraw funds with ease. I use Rapid Transfer to quickly fund my account. Merchants

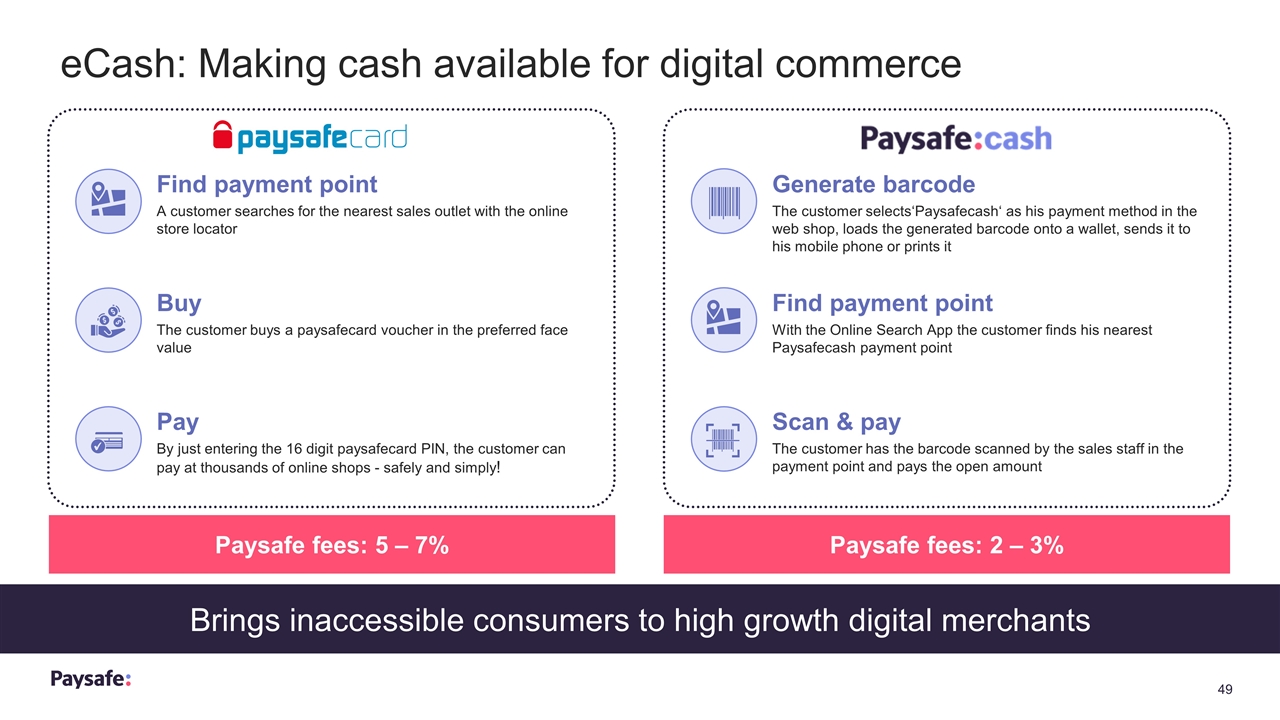

eCash: Making cash available for digital commerce Find payment point A customer searches for the nearest sales outlet with the online store locator Buy The customer buys a paysafecard voucher in the preferred face value Pay By just entering the 16 digit paysafecard PIN, the customer can pay at thousands of online shops - safely and simply! Paysafe fees: 5 – 7% Generate barcode The customer selects‘Paysafecash‘ as his payment method in the web shop, loads the generated barcode onto a wallet, sends it to his mobile phone or prints it Find payment point With the Online Search App the customer finds his nearest Paysafecash payment point Scan & pay The customer has the barcode scanned by the sales staff in the payment point and pays the open amount Paysafe fees: 2 – 3% Brings inaccessible consumers to high growth digital merchants

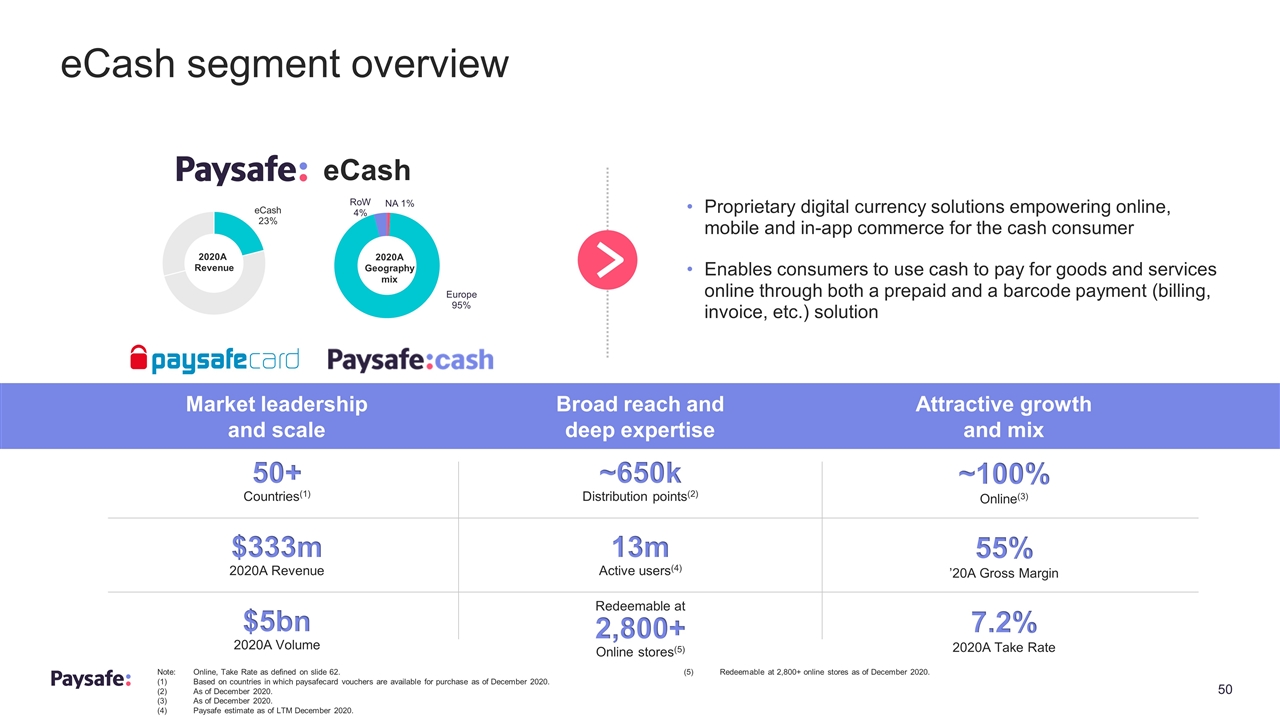

eCash segment overview 7.2% 2020A Take Rate ~100% Online(3) Market leadership and scale Attractive growth and mix Broad reach and deep expertise Proprietary digital currency solutions empowering online, mobile and in-app commerce for the cash consumer Enables consumers to use cash to pay for goods and services online through both a prepaid and a barcode payment (billing, invoice, etc.) solution eCash 2020A Revenue $333m 2020A Revenue $5bn 2020A Volume 50+ Countries(1) ~650k Distribution points(2) Redeemable at 2,800+ Online stores(5) 13m Active users(4) Note:Online, Take Rate as defined on slide 62. (1)Based on countries in which paysafecard vouchers are available for purchase as of December 2020. (2)As of December 2020. (3)As of December 2020. (4) Paysafe estimate as of LTM December 2020. (5)Redeemable at 2,800+ online stores as of December 2020. 55% ’20A Gross Margin

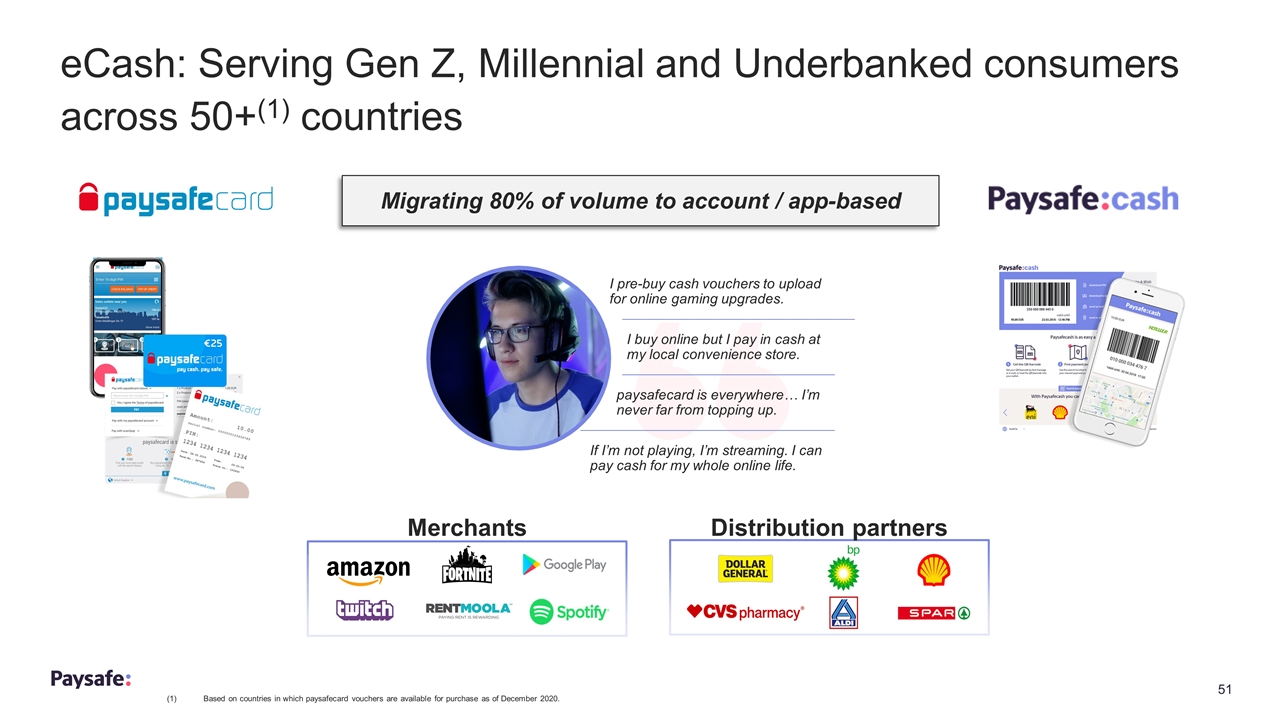

eCash: Serving Gen Z, Millennial and Underbanked consumers across 50+(1) countries paysafecard is everywhere… I’m never far from topping up. I buy online but I pay in cash at my local convenience store. If I’m not playing, I’m streaming. I can pay cash for my whole online life. I pre-buy cash vouchers to upload for online gaming upgrades. Merchants Distribution partners (1)Based on countries in which paysafecard vouchers are available for purchase as of December 2020. Migrating 80% of volume to account / app-based

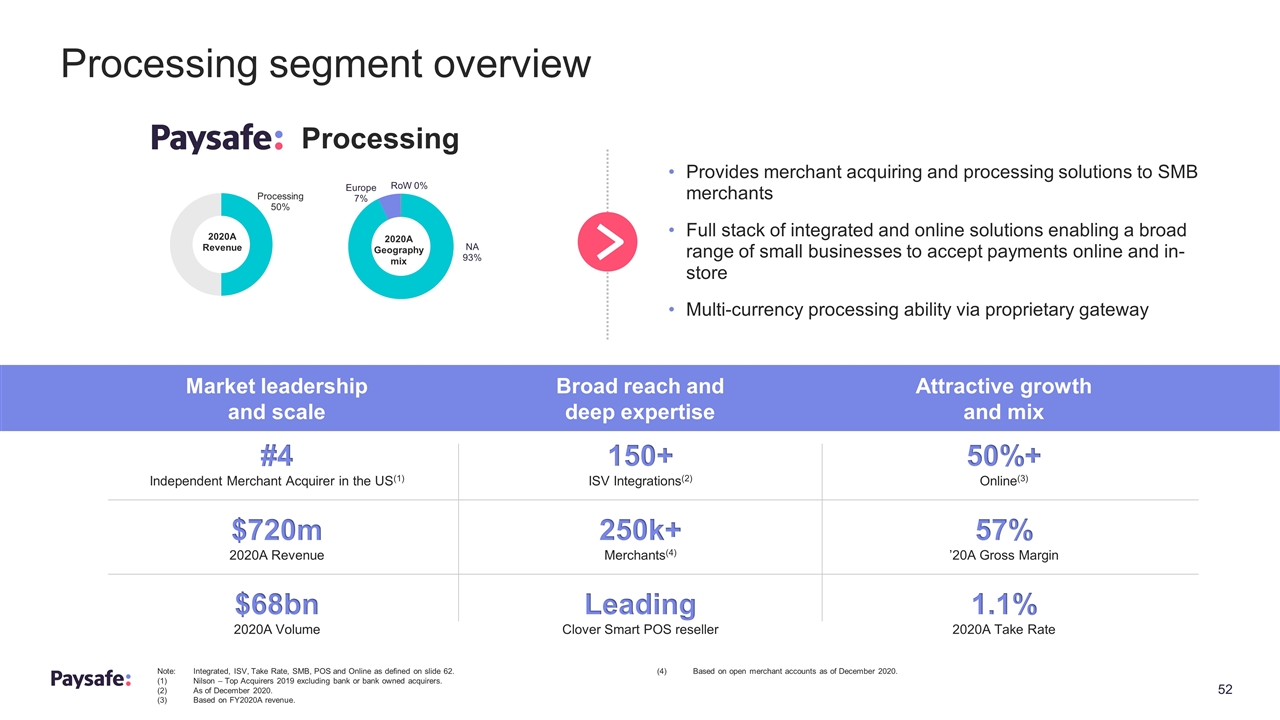

Processing segment overview Note:Integrated, ISV, Take Rate, SMB, POS and Online as defined on slide 62. (1)Nilson – Top Acquirers 2019 excluding bank or bank owned acquirers. (2)As of December 2020. (3)Based on FY2020A revenue. (4)Based on open merchant accounts as of December 2020. Market leadership and scale Attractive growth and mix Broad reach and deep expertise Provides merchant acquiring and processing solutions to SMB merchants Full stack of integrated and online solutions enabling a broad range of small businesses to accept payments online and in-store Multi-currency processing ability via proprietary gateway Processing 2020A Revenue $720m 2020A Revenue $68bn 2020A Volume #4 Independent Merchant Acquirer in the US(1) 1.1% 2020A Take Rate 50%+ Online(3) 150+ ISV Integrations(2) Leading Clover Smart POS reseller 250k+ Merchants(4) 57% ’20A Gross Margin

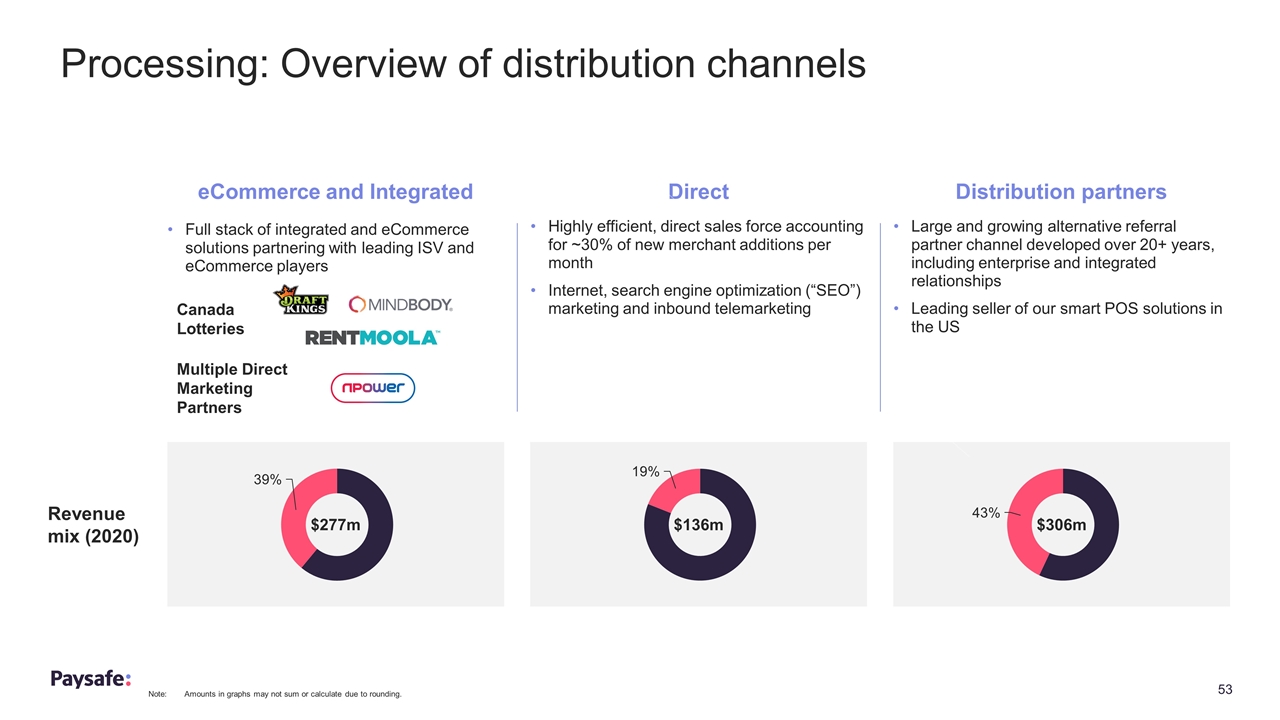

Processing: Overview of distribution channels Revenue mix (2020) $277m $136m $306m eCommerce and Integrated Direct Distribution partners Full stack of integrated and eCommerce solutions partnering with leading ISV and eCommerce players Highly efficient, direct sales force accounting for ~30% of new merchant additions per month Internet, search engine optimization (“SEO”) marketing and inbound telemarketing Large and growing alternative referral partner channel developed over 20+ years, including enterprise and integrated relationships Leading seller of our smart POS solutions in the US Canada Lotteries Multiple Direct Marketing Partners Note:Amounts in graphs may not sum or calculate due to rounding.

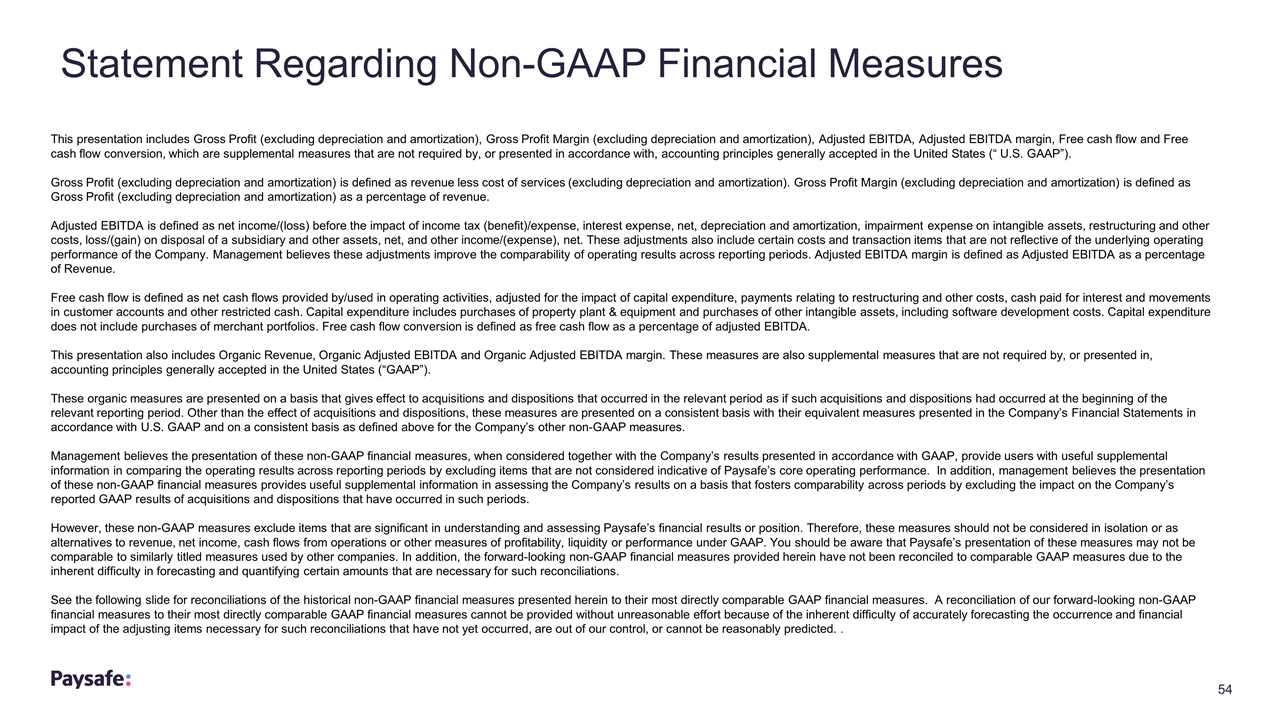

This presentation includes Gross Profit (excluding depreciation and amortization), Gross Profit Margin (excluding depreciation and amortization), Adjusted EBITDA, Adjusted EBITDA margin, Free cash flow and Free cash flow conversion, which are supplemental measures that are not required by, or presented in accordance with, accounting principles generally accepted in the United States (“ U.S. GAAP”). Gross Profit (excluding depreciation and amortization) is defined as revenue less cost of services (excluding depreciation and amortization). Gross Profit Margin (excluding depreciation and amortization) is defined as Gross Profit (excluding depreciation and amortization) as a percentage of revenue. Adjusted EBITDA is defined as net income/(loss) before the impact of income tax (benefit)/expense, interest expense, net, depreciation and amortization, impairment expense on intangible assets, restructuring and other costs, loss/(gain) on disposal of a subsidiary and other assets, net, and other income/(expense), net. These adjustments also include certain costs and transaction items that are not reflective of the underlying operating performance of the Company. Management believes these adjustments improve the comparability of operating results across reporting periods. Adjusted EBITDA margin is defined as Adjusted EBITDA as a percentage of Revenue. Free cash flow is defined as net cash flows provided by/used in operating activities, adjusted for the impact of capital expenditure, payments relating to restructuring and other costs, cash paid for interest and movements in customer accounts and other restricted cash. Capital expenditure includes purchases of property plant & equipment and purchases of other intangible assets, including software development costs. Capital expenditure does not include purchases of merchant portfolios. Free cash flow conversion is defined as free cash flow as a percentage of adjusted EBITDA. This presentation also includes Organic Revenue, Organic Adjusted EBITDA and Organic Adjusted EBITDA margin. These measures are also supplemental measures that are not required by, or presented in, accounting principles generally accepted in the United States (“GAAP”). These organic measures are presented on a basis that gives effect to acquisitions and dispositions that occurred in the relevant period as if such acquisitions and dispositions had occurred at the beginning of the relevant reporting period. Other than the effect of acquisitions and dispositions, these measures are presented on a consistent basis with their equivalent measures presented in the Company’s Financial Statements in accordance with U.S. GAAP and on a consistent basis as defined above for the Company’s other non-GAAP measures. Management believes the presentation of these non-GAAP financial measures, when considered together with the Company’s results presented in accordance with GAAP, provide users with useful supplemental information in comparing the operating results across reporting periods by excluding items that are not considered indicative of Paysafe’s core operating performance. In addition, management believes the presentation of these non-GAAP financial measures provides useful supplemental information in assessing the Company’s results on a basis that fosters comparability across periods by excluding the impact on the Company’s reported GAAP results of acquisitions and dispositions that have occurred in such periods. However, these non-GAAP measures exclude items that are significant in understanding and assessing Paysafe’s financial results or position. Therefore, these measures should not be considered in isolation or as alternatives to revenue, net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that Paysafe’s presentation of these measures may not be comparable to similarly titled measures used by other companies. In addition, the forward-looking non-GAAP financial measures provided herein have not been reconciled to comparable GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. See the following slide for reconciliations of the historical non-GAAP financial measures presented herein to their most directly comparable GAAP financial measures. A reconciliation of our forward-looking non-GAAP financial measures to their most directly comparable GAAP financial measures cannot be provided without unreasonable effort because of the inherent difficulty of accurately forecasting the occurrence and financial impact of the adjusting items necessary for such reconciliations that have not yet occurred, are out of our control, or cannot be reasonably predicted. . Statement Regarding Non-GAAP Financial Measures

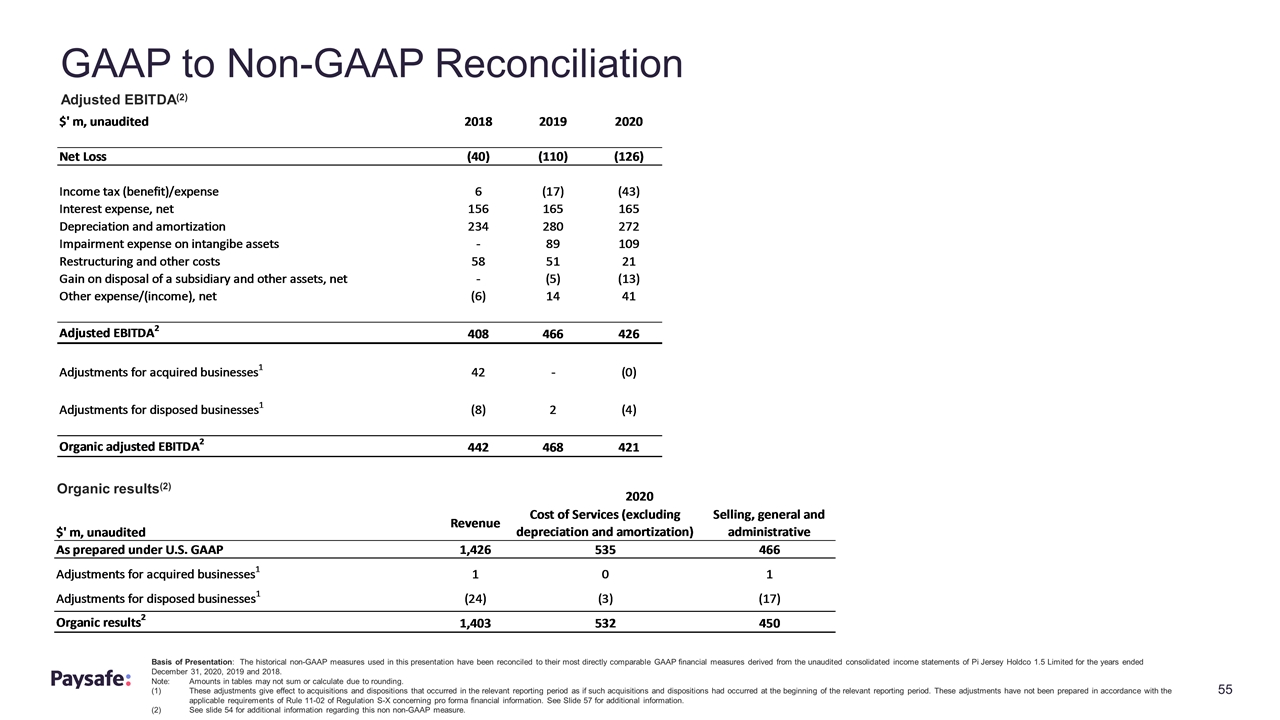

GAAP to Non-GAAP Reconciliation Basis of Presentation: The historical non-GAAP measures used in this presentation have been reconciled to their most directly comparable GAAP financial measures derived from the unaudited consolidated income statements of Pi Jersey Holdco 1.5 Limited for the years ended December 31, 2020, 2019 and 2018. Note:Amounts in tables may not sum or calculate due to rounding. (1)These adjustments give effect to acquisitions and dispositions that occurred in the relevant reporting period as if such acquisitions and dispositions had occurred at the beginning of the relevant reporting period. These adjustments have not been prepared in accordance with the applicable requirements of Rule 11-02 of Regulation S-X concerning pro forma financial information. See Slide 57 for additional information. (2)See slide 54 for additional information regarding this non non-GAAP measure. Adjusted EBITDA(2) Organic results(2)

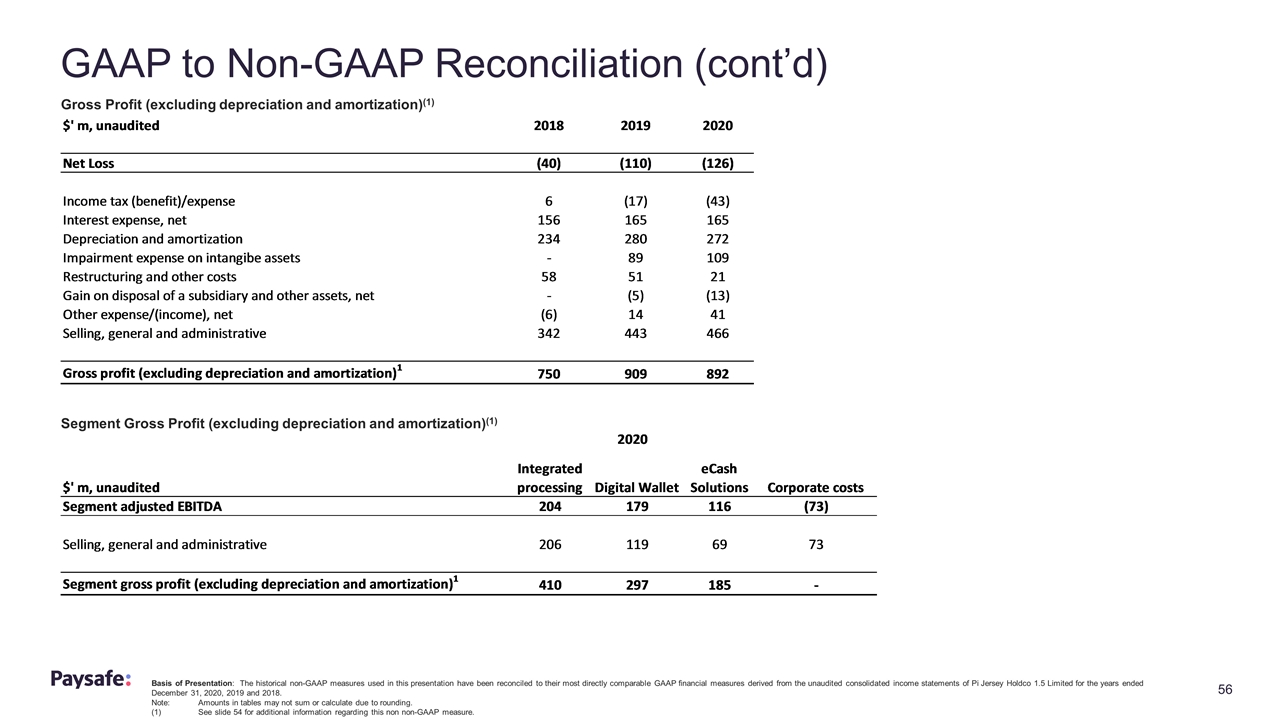

GAAP to Non-GAAP Reconciliation (cont’d) Basis of Presentation: The historical non-GAAP measures used in this presentation have been reconciled to their most directly comparable GAAP financial measures derived from the unaudited consolidated income statements of Pi Jersey Holdco 1.5 Limited for the years ended December 31, 2020, 2019 and 2018. Note:Amounts in tables may not sum or calculate due to rounding. (1)See slide 54 for additional information regarding this non non-GAAP measure. Gross Profit (excluding depreciation and amortization)(1) Segment Gross Profit (excluding depreciation and amortization)(1)

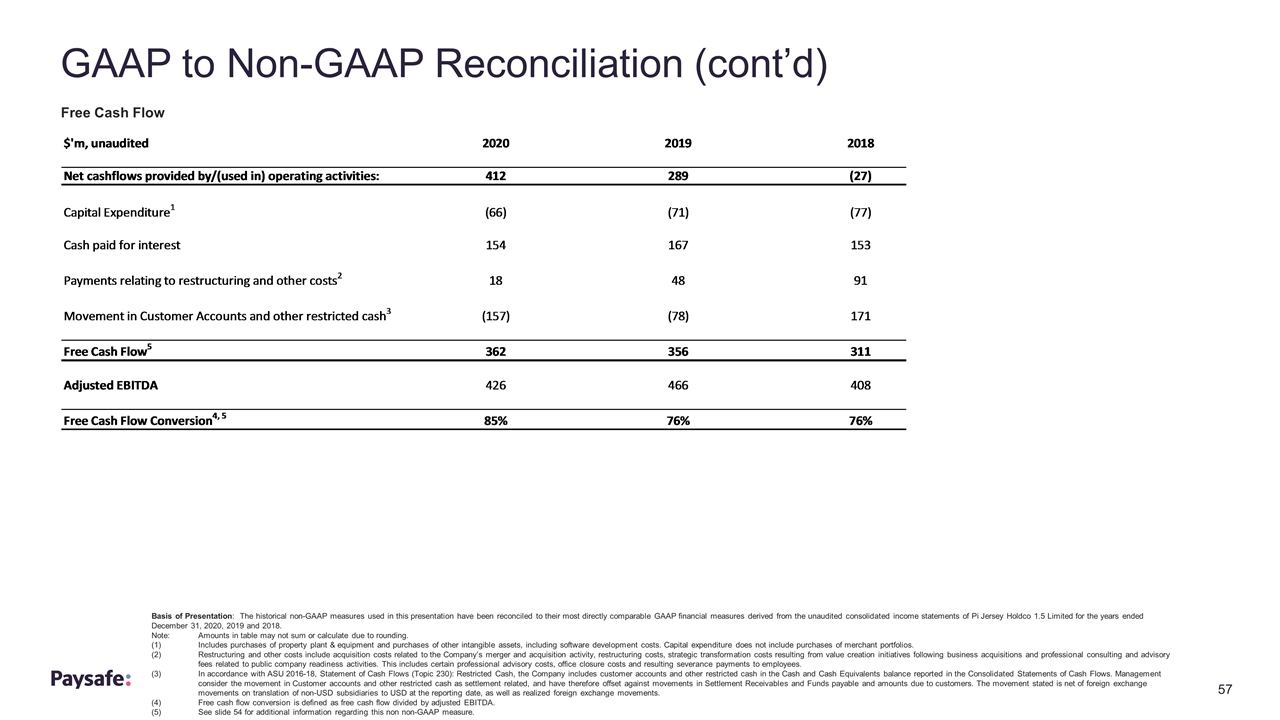

GAAP to Non-GAAP Reconciliation (cont’d) Basis of Presentation: The historical non-GAAP measures used in this presentation have been reconciled to their most directly comparable GAAP financial measures derived from the unaudited consolidated income statements of Pi Jersey Holdco 1.5 Limited for the years ended December 31, 2020, 2019 and 2018. Note:Amounts in table may not sum or calculate due to rounding. (1)Includes purchases of property plant & equipment and purchases of other intangible assets, including software development costs. Capital expenditure does not include purchases of merchant portfolios. (2)Restructuring and other costs include acquisition costs related to the Company’s merger and acquisition activity, restructuring costs, strategic transformation costs resulting from value creation initiatives following business acquisitions and professional consulting and advisory fees related to public company readiness activities. This includes certain professional advisory costs, office closure costs and resulting severance payments to employees. (3)In accordance with ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash, the Company includes customer accounts and other restricted cash in the Cash and Cash Equivalents balance reported in the Consolidated Statements of Cash Flows. Management consider the movement in Customer accounts and other restricted cash as settlement related, and have therefore offset against movements in Settlement Receivables and Funds payable and amounts due to customers. The movement stated is net of foreign exchange movements on translation of non-USD subsidiaries to USD at the reporting date, as well as realized foreign exchange movements. (4)Free cash flow conversion is defined as free cash flow divided by adjusted EBITDA. (5)See slide 54 for additional information regarding this non non-GAAP measure. Free Cash Flow

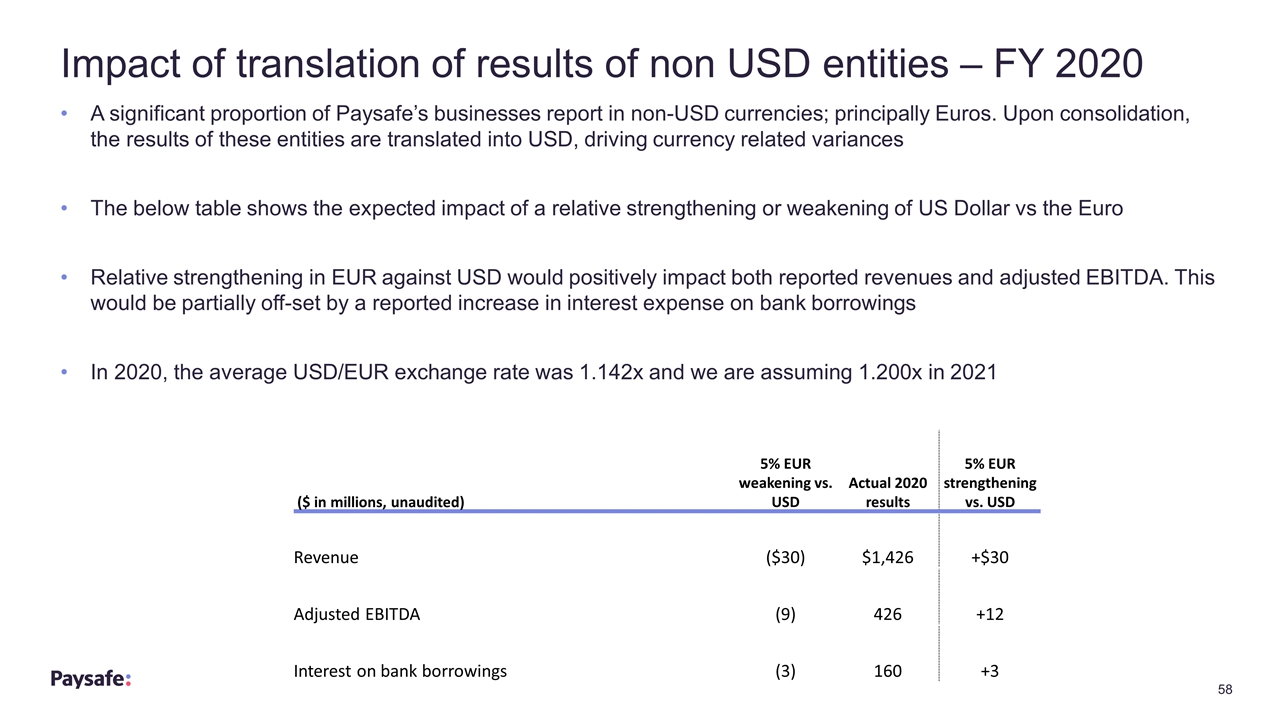

Impact of translation of results of non USD entities – FY 2020 ($ in millions, unaudited) 5% EUR weakening vs. USD Actual 2020 results 5% EUR strengthening vs. USD Revenue ($30) $1,426 +$30 Adjusted EBITDA (9) 426 +12 Interest on bank borrowings (3) 160 +3 A significant proportion of Paysafe’s businesses report in non-USD currencies; principally Euros. Upon consolidation, the results of these entities are translated into USD, driving currency related variances The below table shows the expected impact of a relative strengthening or weakening of US Dollar vs the Euro Relative strengthening in EUR against USD would positively impact both reported revenues and adjusted EBITDA. This would be partially off-set by a reported increase in interest expense on bank borrowings In 2020, the average USD/EUR exchange rate was 1.142x and we are assuming 1.200x in 2021

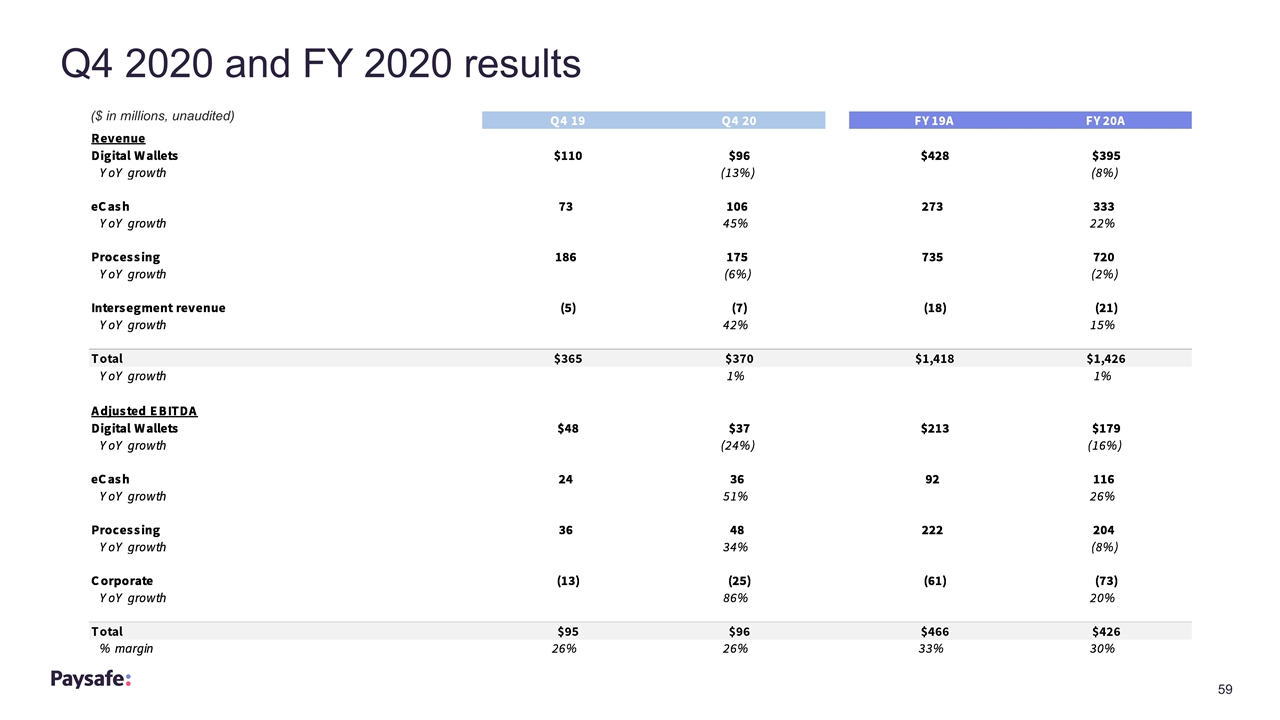

Q4 2020 and FY 2020 results ($ in millions, unaudited)

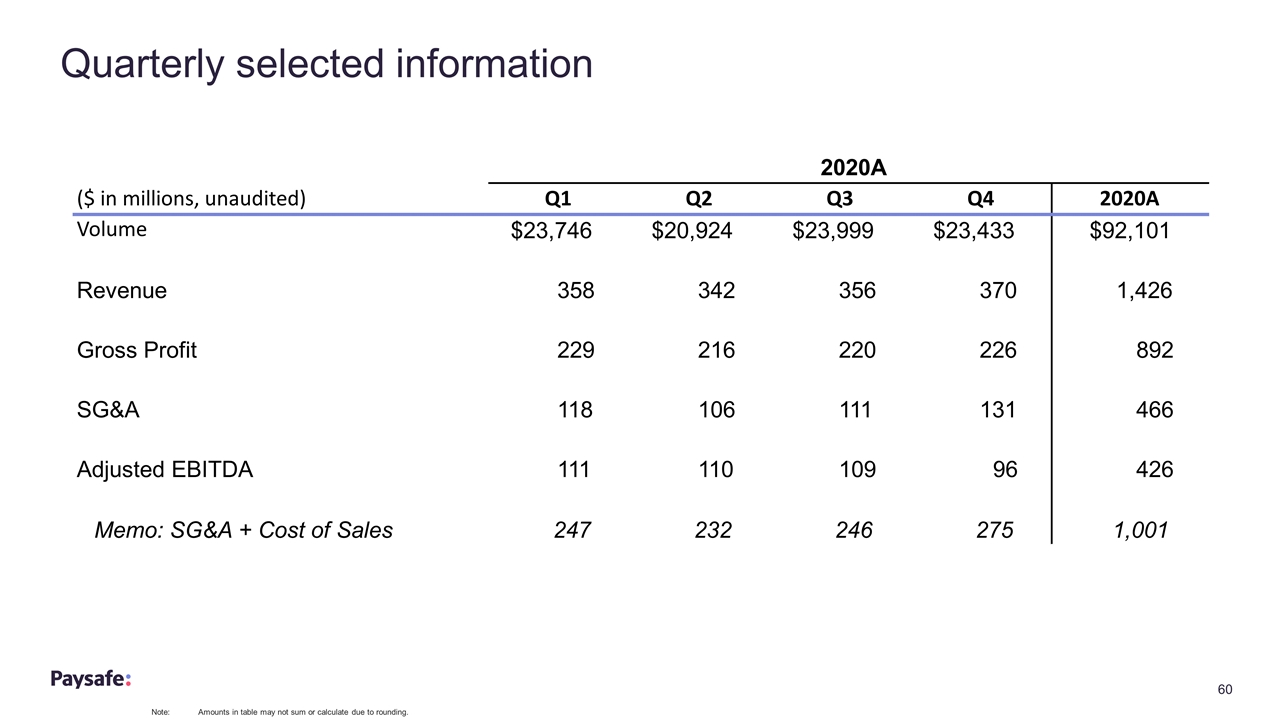

Quarterly selected information Note:Amounts in table may not sum or calculate due to rounding. 2020A ($ in millions, unaudited) Q1 Q2 Q3 Q4 2020A Volume $23,746 $20,924 $23,999 $23,433 $92,101 Revenue 358 342 356 370 1,426 Gross Profit 229 216 220 226 892 SG&A 118 106 111 131 466 Adjusted EBITDA 111 110 109 96 426 Memo: SG&A + Cost of Sales 247 232 246 275 1,001

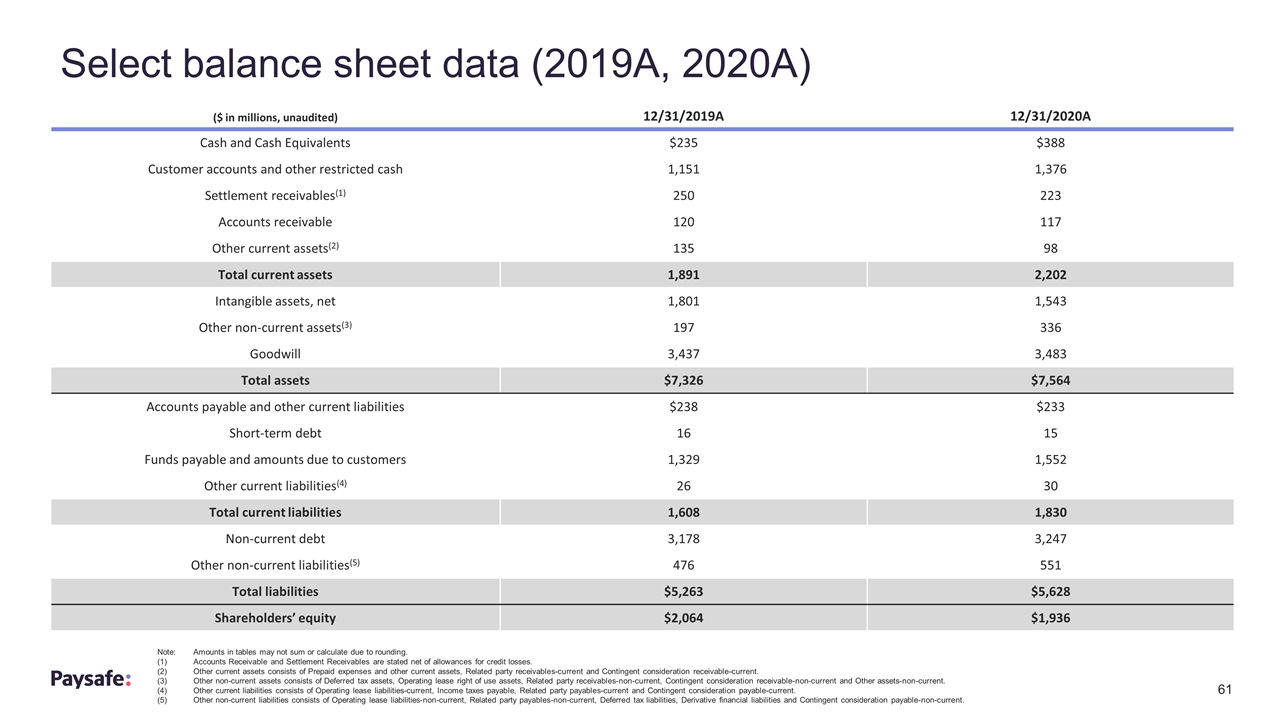

($ in millions, unaudited) 12/31/2019A 12/31/2020A Cash and Cash Equivalents $235 $388 Customer accounts and other restricted cash 1,151 1,376 Settlement receivables(1) 250 223 Accounts receivable 120 117 Other current assets(2) 135 98 Total current assets 1,891 2,202 Intangible assets, net 1,801 1,543 Other non-current assets(3) 197 336 Goodwill 3,437 3,483 Total assets $7,326 $7,564 Accounts payable and other current liabilities $238 $233 Short-term debt 16 15 Funds payable and amounts due to customers 1,329 1,552 Other current liabilities(4) 26 30 Total current liabilities 1,608 1,830 Non-current debt 3,178 3,247 Other non-current liabilities(5) 476 551 Total liabilities $5,263 $5,628 Shareholders’ equity $2,064 $1,936 Select balance sheet data (2019A, 2020A) Note:Amounts in tables may not sum or calculate due to rounding. (1)Accounts Receivable and Settlement Receivables are stated net of allowances for credit losses. (2)Other current assets consists of Prepaid expenses and other current assets, Related party receivables-current and Contingent consideration receivable-current. (3)Other non-current assets consists of Deferred tax assets, Operating lease right of use assets, Related party receivables-non-current, Contingent consideration receivable-non-current and Other assets-non-current. (4)Other current liabilities consists of Operating lease liabilities-current, Income taxes payable, Related party payables-current and Contingent consideration payable-current. (5)Other non-current liabilities consists of Operating lease liabilities-non-current, Related party payables-non-current, Deferred tax liabilities, Derivative financial liabilities and Contingent consideration payable-non-current.

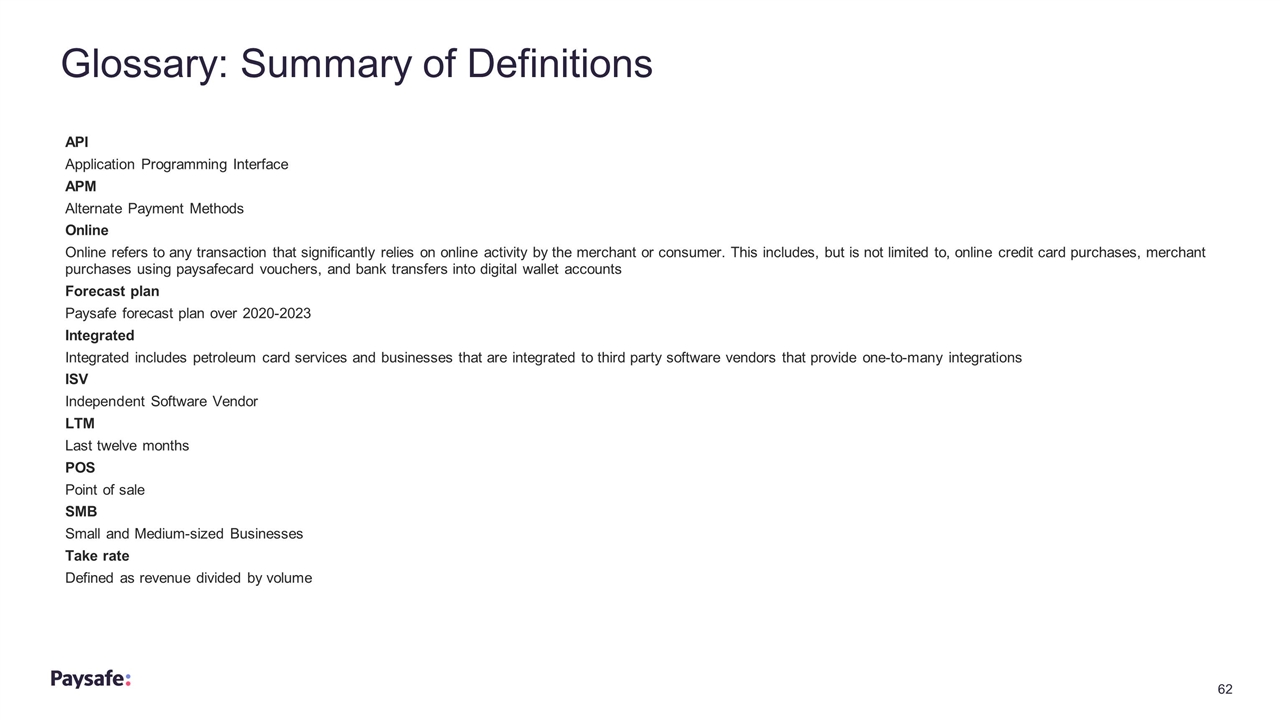

Glossary: Summary of Definitions API Application Programming Interface APM Alternate Payment Methods Online Online refers to any transaction that significantly relies on online activity by the merchant or consumer. This includes, but is not limited to, online credit card purchases, merchant purchases using paysafecard vouchers, and bank transfers into digital wallet accounts Forecast plan Paysafe forecast plan over 2020-2023 Integrated Integrated includes petroleum card services and businesses that are integrated to third party software vendors that provide one-to-many integrations ISV Independent Software Vendor LTM Last twelve months POS Point of sale SMB Small and Medium-sized Businesses Take rate Defined as revenue divided by volume